Winter Camp Spending Traps: How to Protect Your Wallet Without Saying No

You want your child to enjoy a memorable winter camp experience—but suddenly, the costs spiral out of control. From hidden fees to last-minute add-ons, education expenses can sneak up like an uninvited guest. I’ve been there, overbudget and stressed, learning the hard way. This is about smarter choices, not cutting corners. Let’s talk real risk control: how to avoid financial pitfalls while still giving your kid the experience they deserve. The goal isn’t to say no to opportunities, but to say yes with clarity, confidence, and control. Financial peace during the holiday season isn’t about spending less—it’s about spending wisely.

The First Shock: When “All-Inclusive” Isn’t

It starts with a brochure or website promising an “all-inclusive” winter camp experience at a fixed price. That number looks manageable—perhaps even reasonable. But within days of registration, additional charges appear: transportation to remote locations, required gear rentals, meal upgrades, or specialty activity fees. What was once a $1,200 package quietly balloons to $1,800. This bait-and-switch isn’t always intentional deception, but it reflects a broader trend in educational marketing: the use of incomplete pricing to attract interest. Parents are drawn in by simplicity, only to face complexity later. The real cost isn’t just monetary—it’s the stress of unexpected decisions under time pressure.

Transparency is the first line of defense. When reviewing camp offerings, look beyond the headline price. Ask specifically what is and isn’t included. Is lodging covered for the full duration? Are meals provided, or will snacks and dinners require extra payments? What about equipment—will your child need to rent skis, boots, or art supplies? Some programs assume families already own certain items, while others bundle them seamlessly into the base fee. A red flag is any description that uses vague terms like “most activities included” or “basic materials provided.” These phrases leave room for interpretation—and often, for added costs.

Another warning sign is the absence of a detailed itemized invoice during registration. Reputable programs provide a breakdown early in the process, not after enrollment. If the camp website lacks specifics, reach out directly. A simple email asking for a full cost outline can prevent surprises. Consider this: two camps may advertise similar prices, but one includes transport, insurance, and meals, while the other charges separately for each. The difference could amount to hundreds of dollars. Early detection of these gaps allows for informed comparison, turning emotional decisions into strategic ones. Financial discipline begins with visibility—knowing exactly where every dollar goes before you commit.

Peer Pressure on a Budget: Keeping Up Without Breaking Down

It’s natural to want your child to feel included, especially when friends talk excitedly about their upcoming two-week adventure in the mountains or a prestigious arts program abroad. The unspoken pressure to “keep up” can quietly influence decisions, nudging parents toward pricier options not because they’re better, but because they’re popular. This phenomenon, often driven by FOMO—fear of missing out—can distort financial judgment. The emotional weight of saying no to your child, combined with social comparison, makes premium camps seem like necessities rather than luxuries. Yet, higher cost does not automatically mean higher value. In fact, many local or community-based programs deliver comparable developmental benefits at a fraction of the price.

To counter emotional spending, shift focus from perception to outcomes. Ask: What specific skills will my child gain? Is there structured learning, mentorship, or measurable progress built into the program? A $2,500 camp that offers little more than unstructured play may provide fun, but limited long-term benefit. Conversely, a $900 local science camp with certified instructors and project-based curriculum can foster curiosity, teamwork, and problem-solving. The key is distinguishing between prestige and substance. Status-driven choices often serve adult egos more than child development.

Another strategy is to involve your child in the decision-making process. Frame it not as a limitation, but as a shared exploration. “We have a budget to make this experience great—how can we use it wisely?” This approach builds financial literacy and emotional resilience. Children learn that choices involve trade-offs, and that meaningful experiences don’t require the highest price tag. Some families even set a “camp fund” goal, saving incrementally so the expense feels earned rather than burdensome. When spending aligns with values—not peer trends—the decision becomes empowering, not stressful.

Payment Plans That Hide the Real Cost

Installment plans are marketed as a convenience, making large payments feel manageable. Instead of writing a $1,500 check upfront, you’re asked to pay $300 per month for five months. The relief is immediate—your cash flow isn’t disrupted. But this ease comes with a hidden cost: the illusion of affordability. Spreading payments over time doesn’t reduce the total amount owed; it merely delays the financial impact. Worse, it can mask strain on your household budget, especially if other seasonal expenses—holiday gifts, heating bills, or medical co-pays—coincide with camp installments.

Behavioral economics explains this as “temporal discounting”—the tendency to perceive future costs as less painful than present ones. Paying later feels easier than paying now, even if the total burden is the same. But money spent on camp installments is money not saved for emergencies, not invested in college funds, and not used to reduce debt. These are opportunity costs—real financial trade-offs that rarely appear in camp brochures. Before agreeing to any payment plan, calculate the full annual impact. Will these monthly charges overlap with back-to-school expenses or tax season? Could they delay progress on other financial goals?

A better approach is to treat the total cost as a single financial event, even if payments are staggered. Build the full amount into your annual budget, as you would a car repair or home maintenance. If possible, save the entire sum in advance in a dedicated account. This creates a psychological barrier against overspending and ensures funds are truly available. If installments are necessary, confirm there are no added fees or interest. Some programs partner with third-party lenders who charge finance fees—effectively turning camp into a high-interest loan. Always read the fine print. Financial flexibility should never come at the cost of long-term stability.

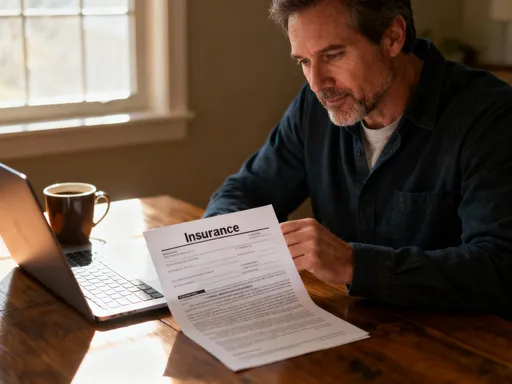

The Insurance Blind Spot Nobody Talks About

Most parents assume that once they’ve paid, the plan is set. But life is unpredictable—illness, family emergencies, or weather disruptions can force a last-minute cancellation. And when that happens, many discover their deposit is non-refundable. Some camps offer limited refund policies, such as 50% back if canceled 60 days in advance, but nothing beyond that. Without protection, families face total loss of hundreds or even thousands of dollars. This is the insurance blind spot: the assumption that payment equals security, when in reality, it only secures the camp’s revenue, not your family’s flexibility.

Third-party trip protection plans can mitigate this risk, but they’re often overlooked or dismissed as unnecessary. These policies typically cover cancellations due to medical issues, injury, or severe weather. Premiums usually range from 4% to 8% of the total cost—a small price compared to losing the full amount. However, not all policies are equal. Some exclude pre-existing conditions or have strict documentation requirements. Read the terms carefully. Is a doctor’s note required? Are mental health-related absences covered? For families with chronic health concerns, these details matter.

Alternatively, check whether your existing homeowner’s or renter’s insurance includes personal liability or medical coverage that might extend to camp-related incidents. Some credit cards also offer travel insurance benefits when you book with them—though camp payments may not always qualify. The point is to assess risk before it materializes. Ask the camp directly about their cancellation policy and whether they recommend or partner with any insurance providers. Proactive planning doesn’t eliminate uncertainty, but it reduces financial exposure. Knowing you’re protected allows you to make decisions based on your child’s needs, not fear of loss.

Location vs. Value: Is Farther Always Better?

There’s a common assumption that distance equals quality—that a camp several states away or in another country must be superior to a local option. This belief is often reinforced by branding: international programs, elite university affiliations, or celebrity endorsements. But geographic prestige doesn’t guarantee educational value. In fact, the added costs of travel, accommodation for parent drop-off, and time off work can significantly inflate the total expense, with little to show in return. A two-day flight, airport transfers, and hotel stay could add $1,200 to the bill—money that doesn’t go toward your child’s learning.

Instead, evaluate programs based on supervision ratios, instructor qualifications, and curriculum design—not just location. A well-run local camp may offer smaller group sizes, more personalized attention, and stronger safety protocols than a distant, high-volume program. Consider also the emotional impact on your child. Being far from home during a winter break may increase homesickness, especially for younger campers. Frequent communication may be limited, and emergency access more difficult. These factors affect well-being, which in turn influences the overall experience.

Additionally, local programs often integrate with community resources—libraries, nature centers, or university labs—providing rich learning environments without the travel premium. They may also offer flexible scheduling, allowing your child to participate without missing extended school time. When comparing options, create a side-by-side analysis: total cost (including travel), duration, safety measures, and learning outcomes. You may find that the “lesser-known” option delivers equal or greater value. Choosing proximity over prestige isn’t settling—it’s prioritizing substance over spectacle.

What You’re Not Being Told About Sponsorships and Subsidies

Many camps offer financial assistance, but the information isn’t always easy to find. Discount programs, sliding-scale fees, or need-based grants are often mentioned in small print or require direct inquiry. Some organizations partner with local businesses, religious institutions, or nonprofit foundations to sponsor spots for low- and middle-income families. These opportunities exist, but they’re underutilized because parents assume they won’t qualify or feel uncomfortable asking. Yet, most camps want to fill every seat and are willing to work with families to make participation possible.

Start by looking for early-bird registration discounts, which can reduce costs by 10% to 15%. Some programs offer sibling rates or group enrollments—sign up with two or more families, and everyone pays less. Community centers, schools, and youth organizations sometimes negotiate bulk rates with camps and pass the savings on. Don’t hesitate to ask: “Are there any scholarships or payment assistance options available?” The question alone can open doors. In many cases, applications are confidential, and eligibility is broader than expected. Income isn’t the only factor—some programs consider family size, recent job changes, or medical expenses.

Another overlooked resource is employer-sponsored benefits. Some companies offer dependent care assistance or education stipends that can be applied to enrichment programs. Check your HR policies or flexible spending accounts (FSAs) to see if camp fees qualify. Local service clubs like Rotary or Kiwanis may also fund youth development initiatives. The key is to research proactively and ask questions without shame. Financial support isn’t a handout—it’s a tool for access. By exploring all avenues, you honor your child’s potential without compromising your budget.

Building a Smart Pre-Approval Framework

Before enrolling in any program, establish a clear financial framework. This isn’t about restriction—it’s about intentionality. Begin by defining your priorities: Is the goal academic enrichment, social development, physical activity, or creative expression? Rank these values, then seek programs that align. Next, set a hard spending cap based on your household budget. This number should include not just the base fee, but estimated extras like travel, gear, and insurance. Once the limit is set, treat it as non-negotiable. This prevents emotional overspending when faced with appealing add-ons.

Next, create a decision checklist. Include items like: full cost transparency, cancellation policy, supervision quality, and educational outcomes. Rate each camp on these criteria, not just price or popularity. Involve your child in the process, explaining the budget as a tool for making smart choices, not a barrier. This teaches responsibility and sets expectations. Consider also the timing of payments—can you save monthly to cover the cost, or will it strain current cash flow? Align the expense with long-term goals, such as college savings or debt reduction. Every dollar spent on camp is a dollar not available elsewhere.

Finally, document your decision. Write down why you chose a particular program, how it fits your goals, and what trade-offs were made. This record helps reinforce discipline and provides clarity if questions arise later. Risk control in family finance isn’t about saying no to every opportunity—it’s about saying yes to the right ones. With a structured approach, you protect your wallet without sacrificing your child’s growth. The most valuable gift you can give isn’t the most expensive camp, but the peace of mind that comes from spending with purpose.