How I Mastered Wealth Transfer: An Expert’s Real Talk on Smarter Inheritance Planning

What happens to your hard-earned wealth when you're gone? I’ve spent years helping families navigate asset inheritance, and one truth stands out: without smart financial planning, even the largest estates can unravel. I’ve seen emotions cloud judgment, taxes erode value, and heirs clash over unclear instructions. But with the right asset allocation strategy, you can protect your legacy. Let me walk you through what actually works—based on real cases, proven methods, and lessons learned the hard way.

The Hidden Crisis in Wealth Transfer

Many people spend decades building wealth, believing that once they’ve accumulated enough, their work is done. But the real challenge begins not in earning, but in transferring that wealth to the next generation. A growing body of research shows that nearly 70% of family wealth disappears by the second generation, and a staggering 90% is lost by the third. These numbers are not due to bad luck or market crashes alone—they stem from a lack of structured planning, poor communication, and an underestimation of legal and tax complexities. Without a deliberate strategy, even million-dollar estates can quickly diminish through avoidable errors.

One of the most common pitfalls is the absence of formal estate documentation. Many individuals assume that verbal agreements or informal understandings with family members are sufficient. In reality, without legally binding wills or trusts, assets are subject to probate—a public, often lengthy, and costly court process. During this time, families may face delays in accessing funds, legal fees, and exposure to disputes among heirs. Worse, if no will exists, state laws determine asset distribution, which may not align with the deceased’s intentions. This can lead to unintended beneficiaries receiving assets while close family members are excluded, creating lasting emotional and financial damage.

Another frequent issue is mismatched beneficiary designations. Retirement accounts, life insurance policies, and certain financial instruments pass directly to named beneficiaries, regardless of what a will states. It’s not uncommon for individuals to forget to update these designations after major life events like divorce or the birth of a child. As a result, an ex-spouse might inherit a 401(k), or a long-estranged relative could receive a life insurance payout. These oversights are preventable but can have irreversible consequences. Additionally, overconcentration in a single asset class—such as holding most of one’s net worth in a family business or a single property—can expose heirs to disproportionate risk. If that asset declines in value or becomes difficult to manage, the entire inheritance may be compromised.

The emotional dynamics surrounding inheritance also play a significant role in its success or failure. Family members may feel entitled to certain assets, leading to conflict when expectations are unmet. Siblings may disagree on how to handle a shared property, or adult children may resent unequal distributions meant to reflect differing needs. Without clear guidance, these tensions can escalate into legal battles that drain both financial and emotional resources. The takeaway is clear: wealth preservation requires more than financial acumen—it demands foresight, structure, and emotional intelligence. By recognizing these hidden risks early, individuals can shift from merely accumulating wealth to strategically allocating it across generations, ensuring that their life’s work endures.

Asset Allocation Beyond Investment Returns

When most people think of asset allocation, they focus on maximizing investment returns during their lifetime. But when it comes to inheritance planning, the goal shifts from personal growth to intergenerational stability. The way assets are distributed across different investment types—equities, fixed income, real estate, and alternative investments—can have a profound impact on how smoothly wealth is transferred and how well it sustains future generations. A portfolio heavily weighted in volatile stocks may deliver strong growth, but it can also leave heirs vulnerable to market downturns at the worst possible time. Similarly, an estate tied up in illiquid real estate may be difficult to divide or manage, especially if beneficiaries lack experience in property ownership.

Diversification is not just a risk management tool; it is a cornerstone of responsible inheritance planning. A balanced mix of asset classes helps ensure that some portion of the estate remains stable even when others fluctuate. For example, fixed income securities such as bonds or dividend-paying stocks can provide steady income to heirs who may rely on the inheritance for living expenses. Real estate can offer long-term appreciation and rental income, but it also comes with management responsibilities and potential tax implications. Alternative investments like private equity or collectibles may hold value, but they often require specialized knowledge to liquidate or maintain. The key is to structure the portfolio so that it aligns not only with the grantor’s values and goals but also with the capabilities and needs of the beneficiaries.

Time horizon is another critical factor that changes when planning for inheritance. While an individual may have decades to recover from market volatility, heirs receiving a lump-sum distribution may not have the same flexibility. A sudden influx of wealth, especially if it includes high-risk assets, can lead to impulsive decisions—such as overspending or poor investment choices—without proper guidance. This is why phased distributions, often facilitated through trusts, can be more effective than outright transfers. By staggering access to funds, families can reduce the risk of mismanagement and allow heirs time to develop financial literacy.

Risk tolerance must also be reassessed in the context of inheritance. What was acceptable for a working professional may not be suitable for a retiree or a young adult inheriting wealth for the first time. A portfolio that once supported an aggressive growth strategy may need to be rebalanced toward more conservative holdings as the focus shifts from accumulation to preservation. Liquidity is equally important: heirs may need immediate access to cash for taxes, legal fees, or living expenses. Ensuring that a portion of the estate is held in liquid, easily accessible accounts can prevent the forced sale of valuable assets at inopportune times. Ultimately, asset allocation in inheritance planning is about balance—balancing growth with stability, control with flexibility, and financial goals with family dynamics.

Legal Tools That Make a Difference

No amount of financial planning can fully protect an estate without the proper legal framework. Wills, trusts, powers of attorney, and beneficiary designations are not just formalities—they are essential tools that define how, when, and to whom assets are transferred. A will is the most basic instrument, outlining the distribution of assets and naming guardians for minor children. However, a will alone is often insufficient. It must go through probate, a court-supervised process that can be slow, expensive, and public. This lack of privacy can expose family details to scrutiny and invite challenges from disgruntled parties. More importantly, probate can delay access to funds for months or even years, creating hardship for dependents who rely on the estate for support.

Trusts offer a more effective alternative. A revocable living trust, for instance, allows the grantor to maintain control over assets during their lifetime while ensuring a seamless transfer upon death. Because assets held in such a trust bypass probate, beneficiaries gain faster access without court involvement. Additionally, trusts provide privacy—unlike wills, they are not part of the public record. This can be especially valuable for families who wish to avoid public disputes or media attention. Trusts also allow for greater control over distribution. For example, a parent can specify that a child receive funds in stages—say, one-third at age 25, one-third at 30, and the remainder at 35—helping to prevent reckless spending and encouraging responsible financial behavior.

Irrevocable trusts serve a different but equally important purpose. Once established, the grantor typically cannot alter the terms, which means the assets are no longer considered part of their taxable estate. This can significantly reduce exposure to estate taxes, particularly for larger estates. These trusts can also protect assets from creditors, lawsuits, or divorce settlements, providing a layer of financial security for beneficiaries. While the loss of control may seem daunting, the long-term benefits often outweigh the drawbacks, especially when preserving wealth across generations is the goal. Other legal tools, such as durable powers of attorney and advance healthcare directives, ensure that trusted individuals can make financial and medical decisions if the grantor becomes incapacitated. These documents prevent court-appointed guardianship, which can be both invasive and inefficient.

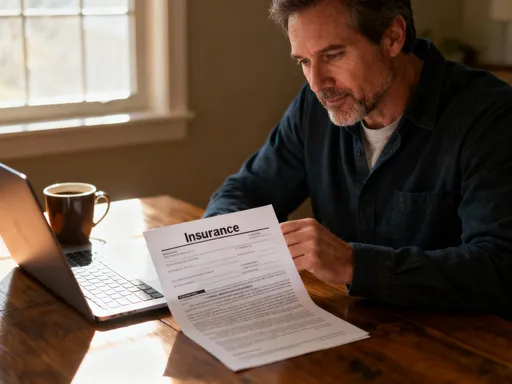

The coordination between financial and legal strategies is crucial. A portfolio may be well-diversified, and tax planning may be sound, but without updated beneficiary designations and properly funded trusts, the plan can fail. For example, if a retirement account names an outdated beneficiary, that designation overrides any instructions in a trust or will. Similarly, if a home is not formally transferred into a trust, it may still be subject to probate. Regular reviews with both financial advisors and estate attorneys are necessary to ensure all components work together seamlessly. Legal tools are not one-time solutions; they must evolve with changing laws, family circumstances, and financial goals. When used correctly, they provide clarity, reduce conflict, and ensure that the grantor’s intentions are honored.

Tax Efficiency: Protecting Value Before It’s Lost

Taxes are one of the most predictable yet frequently overlooked threats to inherited wealth. Without proactive planning, estate, inheritance, and capital gains taxes can quietly erode a significant portion of an individual’s life savings. The federal estate tax, for instance, applies to estates exceeding a certain exemption threshold—currently over $12 million for an individual—but many states impose their own estate or inheritance taxes at much lower levels. A family in a high-tax state could lose tens or even hundreds of thousands of dollars to taxes that could have been minimized with proper strategy. The key is not to avoid taxes illegally, but to use legal mechanisms that reduce the tax burden while staying fully compliant with current regulations.

One of the most effective tools is lifetime gifting. The IRS allows individuals to give up to a certain amount each year—currently $17,000 per recipient in 2023—without triggering gift tax or reducing their lifetime exemption. By gifting assets gradually, individuals can reduce the size of their taxable estate while seeing their loved ones benefit during their lifetime. This approach also allows the giver to witness the impact of their generosity and provide guidance on how the funds are used. For larger transfers, tapping into the lifetime gift and estate tax exemption can enable even more substantial gifting, further shrinking the estate’s taxable value. When done thoughtfully, this strategy not only lowers future tax liability but also strengthens family relationships.

Another powerful concept is the stepped-up basis. When heirs inherit assets such as stocks or real estate, the cost basis is adjusted to the market value at the time of death. This can eliminate capital gains taxes on decades of appreciation. For example, if someone bought stock for $10,000 that is worth $500,000 at their death, the heir receives it with a $500,000 basis. If they sell it immediately, there is no capital gains tax. Without this rule, the heir could face a large tax bill upon sale. Understanding and leveraging the stepped-up basis is essential for preserving wealth, particularly in portfolios with highly appreciated assets. However, this benefit only applies at death—selling assets before passing away may trigger immediate capital gains taxes, reducing what ultimately reaches the heirs.

Tax-advantaged accounts like IRAs and 401(k)s require special attention. Since these accounts have not yet been taxed, distributions to heirs are subject to income tax. Under current rules, most non-spouse beneficiaries must withdraw the funds within ten years, potentially pushing them into higher tax brackets. To mitigate this, some individuals choose to take required minimum distributions earlier in retirement, paying taxes at a lower rate while alive, thereby reducing the taxable balance passed on. Roth conversions—transferring pre-tax retirement funds to a Roth IRA and paying taxes now—can also be a smart move, especially if future tax rates are expected to rise. Heirs can then withdraw Roth funds tax-free, preserving more value. These strategies require careful timing and coordination but can lead to substantial savings over time.

Communicating Your Plan to Heirs

Even the most meticulously crafted financial and legal plan can unravel if heirs are left in the dark. Surprises, misunderstandings, and unmet expectations are among the leading causes of family conflict after a loved one’s passing. Many parents delay conversations about inheritance out of discomfort, fear of appearing self-centered, or concern that discussing money will create greed or tension. Yet silence often does more harm than good. Without context, heirs may misinterpret decisions—such as unequal distributions or the use of trusts—as signs of favoritism or unfairness, even when they reflect thoughtful planning.

Transparency, when handled with care, fosters understanding and responsibility. Families that engage in open, age-appropriate discussions about wealth are better equipped to manage it. These conversations don’t need to disclose exact dollar amounts but should explain the values behind the plan. For example, a parent might explain that a trust is designed to support education or homeownership, not to enable a lavish lifestyle. They might share stories about their own financial journey—the sacrifices made, the lessons learned—to help heirs appreciate the effort behind the wealth. This narrative builds emotional connection and reinforces the idea that money is a tool, not an entitlement.

Family meetings, facilitated by a trusted advisor, can provide a neutral setting for these discussions. A financial planner or estate attorney can explain complex structures like trusts or tax strategies in accessible terms, reducing confusion and anxiety. Letters of intent—non-legal documents that express personal wishes—can also be powerful. A handwritten note explaining why a particular piece of jewelry goes to one child or why a family home should be preserved can carry deep emotional weight. These gestures humanize the planning process and help heirs see beyond the numbers.

Gradual financial education is another key component. Rather than handing over a large sum at once, some families introduce younger members to investing, budgeting, and charitable giving through small allowances or custodial accounts. This builds competence and confidence over time. The goal is not to create financiers, but to cultivate wisdom—so that when wealth is transferred, it is received with maturity and purpose. When heirs understand the plan, they are more likely to respect it, less likely to fight over it, and better prepared to steward it for future generations.

Adapting to Life Changes Without Losing Focus

Life is unpredictable, and no inheritance plan should be set in stone. Major events—marriage, divorce, the birth of a child, the death of a loved one, or a career change—can all alter financial needs, family dynamics, and long-term goals. A plan that made sense ten years ago may no longer reflect current realities. For example, a trust established to support a child with special needs may need adjustments if new government benefits become available. A business owner who once planned to pass the company to a son may reconsider if the son chooses a different career path. Without regular reviews, outdated provisions can lead to unintended consequences.

A disciplined review process is essential. Financial and legal documents should be revisited at least every three to five years, or immediately after a significant life event. This includes updating beneficiary designations on retirement accounts, life insurance policies, and payable-on-death accounts. It also means reassessing asset allocation in light of changing risk tolerance and time horizon. An individual who once had a high-risk portfolio may need to shift toward more conservative investments as they approach retirement or as their estate planning goals evolve. Similarly, if a previously solvent family member falls into financial difficulty, it may be wise to adjust distributions to protect assets from creditors.

Working with trusted advisors ensures continuity and objectivity. Emotions run high during transitions, and decisions made in haste can have long-term repercussions. A financial advisor can help evaluate the impact of changes on tax efficiency and investment strategy, while an estate attorney can ensure that legal documents remain valid and enforceable. These professionals also stay current with changes in tax laws and regulations, which can affect everything from exemption amounts to trust structures. For instance, shifts in federal or state estate tax laws may create new opportunities for gifting or require adjustments to existing plans.

The goal is not perfection, but resilience. A flexible plan acknowledges that life changes and builds in mechanisms to adapt. It includes contingency provisions, such as successor trustees or alternate beneficiaries, and allows for periodic refinement. By treating inheritance planning as an ongoing process rather than a one-time task, individuals can maintain control and clarity, ensuring that their legacy remains aligned with their intentions, no matter what the future holds.

Building a Legacy That Lasts Generations

True wealth transfer is not just about money—it’s about values, responsibility, and continuity. The most enduring legacies are not measured solely by dollar amounts, but by the impact they have on future generations. A well-structured inheritance plan does more than distribute assets; it传递s a sense of purpose. It teaches heirs that wealth comes with stewardship, that privilege carries responsibility, and that financial security is a platform for meaningful contribution. When done thoughtfully, inheritance becomes a bridge between generations, connecting the past to the future through shared values and collective strength.

The integration of asset allocation, legal structure, tax efficiency, and communication forms the foundation of a lasting legacy. Each element supports the others: diversified investments provide stability, trusts and wills ensure control, tax strategies preserve value, and open dialogue builds understanding. Together, they create a system that is greater than the sum of its parts—one that can withstand market fluctuations, legal challenges, and family dynamics. But beyond the mechanics lies the human element. The stories told, the lessons shared, the values modeled—these are what truly endure.

Ultimately, lasting wealth is not just earned; it is carefully, intentionally passed on. It requires foresight, discipline, and love. It demands that we look beyond our own lives and consider the world we leave behind. By planning with clarity and compassion, individuals can ensure that their hard-earned wealth becomes a source of security, opportunity, and inspiration for generations to come. The legacy you build today will shape the choices, dreams, and futures of those who follow. Make it one worth inheriting.