How I Stayed Calm When Disaster Hit—And Protected My Money

Life doesn’t send warnings before accidents strike—mine came with a hospital bill and a stalled income. In that chaos, I realized my finances weren’t just about growth, but resilience. Market swings don’t stop because you’re in crisis. This is how I navigated emergency response without derailing my financial future, using practical moves that align with real market trends—no hype, just what actually worked when it mattered most.

The Wake-Up Call: When Life Interrupts Your Portfolio

It started with a fall—a simple misstep on a rainy sidewalk that led to a fractured hip and three weeks in the hospital. What followed was not just physical recovery, but a financial reckoning. My income paused, but the bills didn’t. Mortgage, utilities, insurance premiums—all kept arriving like clockwork. I had spent years investing in growth stocks, chasing quarterly returns, and optimizing for long-term appreciation. Yet in that moment, none of it mattered. My portfolio was locked in assets that couldn’t be liquidated quickly without loss, and my emergency fund barely covered one month of expenses. The reality hit harder than the fall: financial planning that ignores life’s disruptions is incomplete.

This experience exposed a dangerous gap in conventional financial advice. Most investment strategies focus almost exclusively on returns—how to beat the market, compound wealth, and maximize gains. But they rarely emphasize what happens when life interrupts the plan. A market downturn during a personal crisis multiplies stress. You’re not just watching numbers drop; you’re deciding whether to sell low to cover medical costs or delay treatment to preserve savings. That intersection—where personal instability meets market volatility—is where most financial plans fail. The truth is, your portfolio must be designed not only to grow, but to withstand shock.

For many, especially women in midlife managing household finances, this blind spot is particularly risky. Income may be shared or secondary, caregiving responsibilities are common, and financial confidence can be undermined by years of prioritizing family needs over personal security. When disaster strikes, the pressure intensifies. That’s why emergency preparedness isn’t a sidebar to investing—it’s the foundation. A strategy that doesn’t account for sudden job loss, health issues, or economic instability isn’t truly comprehensive. The wake-up call taught me that resilience isn’t built in crisis; it’s built long before, through deliberate choices that prioritize stability as much as growth.

Market Trends That Matter When You’re in Crisis

When personal emergencies collide with economic uncertainty, the impact is magnified. Over the past decade, markets have experienced repeated disruptions—pandemic shocks, inflation surges, interest rate volatility, and sector-specific downturns. These aren’t anomalies; they’re patterns. And during personal crises, individuals are least equipped to respond. Consider 2020: as markets dropped nearly 30% in weeks, millions also faced job losses or reduced hours. Those who needed cash had no choice but to sell depreciated assets, locking in losses at the worst possible time. The same dynamic played out in 2022, when rising interest rates triggered declines in both stocks and bonds, leaving few safe havens.

What makes these trends dangerous during personal emergencies is their timing. Market corrections don’t wait for your recovery. A downturn can erase gains just as you’re facing a medical bill or home repair. Sectors like travel, hospitality, and retail often suffer first during economic stress—yet many portfolios remain overweight in equities without considering how quickly liquidity can vanish. Even supposedly stable assets like real estate or retirement accounts become inaccessible when immediate cash is needed. The lesson is clear: understanding macroeconomic trends isn’t about predicting the future; it’s about preparing for vulnerability.

Take inflation, for example. In recent years, rising costs have eroded purchasing power, especially for essentials like food, energy, and healthcare. For someone already stretched by medical expenses, this adds another layer of strain. A portfolio that doesn’t include inflation-resistant assets—such as Treasury Inflation-Protected Securities (TIPS) or dividend-paying stocks with pricing power—loses value in real terms. Similarly, liquidity crunches—when banks tighten lending or credit becomes expensive—can prevent access to emergency loans, forcing reliance on high-cost alternatives. These aren’t abstract risks; they’re real pressures that compound during personal crises.

The key insight is that market behavior during stress reveals the limits of traditional investing. Chasing high returns without considering drawdown risk leaves you exposed. Instead, financial planning must incorporate awareness of these trends not to speculate, but to protect. This means structuring portfolios with flexibility, prioritizing access over maximization, and recognizing that stability often matters more than upside during tough times. For the average investor, especially those managing household finances, this shift in focus—from growth at all costs to growth with safeguards—can mean the difference between recovery and long-term setback.

Building a Financial Shock Absorber

Just as a car’s suspension system absorbs road bumps to protect passengers, a financial shock absorber smooths out life’s unexpected jolts. This concept goes beyond a simple emergency fund. It’s a layered defense combining liquidity, insurance, and low-volatility investments designed to maintain stability when income falters or expenses spike. The goal isn’t to eliminate risk—no system can do that—but to reduce the damage when crises occur. For someone managing a household budget, this buffer provides peace of mind, knowing that a medical issue or job interruption won’t trigger a financial collapse.

A well-constructed shock absorber starts with liquid assets—cash or cash equivalents that can be accessed within days without penalty. This includes high-yield savings accounts, money market funds, or short-term certificates of deposit. The rule of thumb is three to six months of essential expenses, but for those with irregular income or health concerns, up to twelve months may be appropriate. Unlike checking accounts that offer minimal interest, these tools provide modest returns while preserving access. They serve as the first line of defense, covering immediate needs without touching long-term investments.

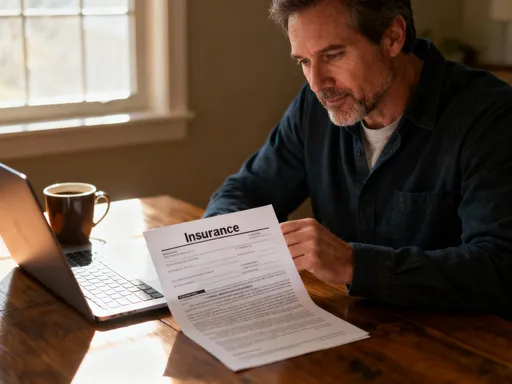

The second layer is insurance—not just health coverage, but disability, long-term care, and umbrella policies. These transfer risk to institutions better equipped to absorb loss. Disability insurance, for instance, replaces a portion of income if you’re unable to work due to illness or injury. Yet studies show fewer than 40% of Americans have this protection, leaving households vulnerable to income disruption. Similarly, long-term care insurance can prevent the depletion of savings due to extended medical needs. While premiums are a cost, they’re often far less than the potential out-of-pocket expenses they prevent.

The third component is a portion of the investment portfolio allocated to low-volatility assets. This includes short-duration bonds, dividend-paying blue-chip stocks, and balanced funds that maintain value during downturns. These holdings aren’t expected to deliver explosive growth, but they provide stability and, in some cases, ongoing income. During the 2008 financial crisis, for example, portfolios with significant bond allocations lost less value and recovered faster than those heavily weighted in equities. By design, this structure reduces exposure to market swings when you can least afford them.

Risk Control: Protecting What You Have

Financial security isn’t just about earning more—it’s about losing less. Risk control is the cornerstone of emergency-ready finance, yet it’s often overlooked in favor of growth strategies. Common risks—job loss, medical emergencies, market corrections—don’t occur in isolation. They compound. A health crisis can lead to lost wages, which forces asset sales at a market low, creating a downward spiral. The goal of risk control is to break that chain by identifying vulnerabilities and putting safeguards in place before disaster strikes.

Diversification remains one of the most effective tools. Spreading investments across asset classes—stocks, bonds, real estate, and cash—reduces the impact of any single sector’s decline. But true diversification goes beyond asset types. It includes geographic exposure, currency variety, and income sources. For a household managing multiple financial responsibilities, this means not relying solely on one income stream or investment account. A spouse’s job, a rental property, or a side business can provide alternative support when primary sources falter.

Asset allocation is equally important. Rather than chasing high-risk, high-reward opportunities, a balanced approach aligns with life stage and risk tolerance. A 45-year-old woman supporting children and aging parents may need a more conservative mix than a single earner in their twenties. This doesn’t mean avoiding stocks altogether, but ensuring that a portion of the portfolio is in stable, income-generating assets that can be drawn on if needed. Rebalancing annually helps maintain this balance, selling high and buying low without emotional decision-making.

Equally critical is having a pre-defined response plan. Panic leads to poor choices—selling everything during a market dip, taking high-interest loans, or skipping necessary care to save money. A written plan outlines exactly what to do in different scenarios: which accounts to tap first, when to contact creditors, how much to withdraw monthly. This removes guesswork in crisis, allowing for calm, rational action. For many, simply knowing the plan exists reduces anxiety and builds confidence in their financial foundation.

Smart Moves That Generate Steady Gains Without Gamble

After my accident, I shifted my mindset from chasing returns to seeking reliability. I realized that wealth isn’t built in dramatic wins, but in consistent, sustainable growth. This doesn’t mean abandoning investing—it means choosing vehicles that align with real-world stability. Dividend-paying stocks, for example, offer regular income and tend to be issued by established companies with strong balance sheets. While they may not double in a year, they often hold value better during downturns and provide cash flow that can cover living expenses without selling shares.

Short-term bonds are another smart choice. Unlike long-term bonds, which lose value when interest rates rise, short-duration bonds reset more quickly, preserving capital. Treasury bonds, municipal bonds, and high-quality corporate bonds offer varying levels of risk and return, but all provide predictable income. For investors wary of stock market swings, bond ladders—staggered maturities—can ensure regular access to funds while maintaining exposure to interest rate changes.

Managed funds, particularly those focused on capital preservation or income generation, offer professional oversight without the burden of daily management. These funds often combine bonds, dividend stocks, and alternative assets to deliver modest but steady returns. They’re especially useful for those who lack time or confidence to manage investments actively. While fees are a consideration, the benefit of diversified, professionally managed exposure often outweighs the cost, particularly during volatile periods.

The goal here isn’t to get rich quickly. It’s to earn enough to maintain stability—to cover insurance premiums, keep up with inflation, and avoid dipping into principal. In a world of financial hype, this approach may seem unexciting. But for someone managing a household budget, raising children, or supporting aging parents, reliability trumps excitement. Steady gains, even at 3% to 5% annually, compound over time and provide a foundation that survives market storms. This is the kind of growth that supports life, not the other way around.

Practical Tools and Habits for Long-Term Resilience

Resilience isn’t created in a single decision—it’s built through daily habits. The most effective financial tools are often the simplest: budgeting, automatic savings, and regular check-ins. A monthly budget that includes a line item for emergencies—treated like any other bill—ensures consistent funding of the shock absorber. Even $100 per month grows to over $6,000 in five years, plus interest. Automating transfers to savings or investment accounts removes temptation and ensures consistency.

Regular portfolio reviews, at least twice a year, help track progress and adjust for life changes. A child leaving for college, a parent needing care, or a shift in employment status all require financial reassessment. These check-ins don’t need to be complex. A few hours with a spreadsheet or financial app can reveal whether allocations still match goals and risk tolerance. The key is consistency—making finance a routine, not a crisis-driven chore.

Tracking net worth annually provides a clear picture of financial health. While daily market moves are noise, long-term trends show whether your strategy is working. A rising net worth, even slowly, indicates progress. A sudden drop may signal overexposure to risk or an overlooked liability. This metric, more than any single account balance, reflects true financial strength.

Finally, staying informed without becoming overwhelmed is essential. Subscribing to reputable financial news sources, attending free webinars, or consulting a fee-only advisor can provide guidance without pressure. The goal isn’t to become an expert, but to make informed decisions. For women who may have deferred financial learning while focusing on family, reclaiming this knowledge is empowering. It builds confidence that no matter what life brings, the plan can hold.

Looking Ahead: Wealth That Survives the Storm

Financial success isn’t measured only in dollars, but in calm during crisis. True wealth is the ability to face the unexpected without panic—knowing that systems are in place, buffers are funded, and decisions have been made in advance. The accident that derailed my income didn’t derail my future because I rebuilt with resilience at the core. My portfolio now balances growth with protection, income with stability, planning with flexibility.

Aligning with market realities—volatility, inflation, liquidity needs—has made my strategy durable. I no longer fear downturns as much as I once did, because I understand they’re part of the cycle. What matters is preparation. By integrating emergency readiness into investing, I’ve created a financial life that supports me, not one I constantly worry about.

The best time to build resilience was years ago. The second-best time is now. You don’t need a perfect plan—just a starting point. Fund a savings account. Review your insurance. Adjust one investment for stability. Small steps, taken consistently, create lasting security. Life will still bring surprises. But with the right foundation, you won’t face them empty-handed. Wealth isn’t just what you accumulate. It’s what you keep—and how well it carries you through the storm.