How I Protected My Investments When Sudden Illness Hit — A Real Strategy

What happens to your finances when a sudden illness changes everything? I learned the hard way. One moment I was building wealth, the next I faced medical bills and lost income. But I didn’t let it destroy my financial future. Instead, I adjusted my investment strategy to protect what mattered most. This is how I stayed resilient — not through luck, but through smart, practical moves anyone can make. The journey wasn’t easy, but it taught me that financial security isn’t just about growing your portfolio; it’s about designing it to withstand life’s hardest moments. This is the strategy that carried me through.

The Wake-Up Call: When Health Crashed My Financial Plans

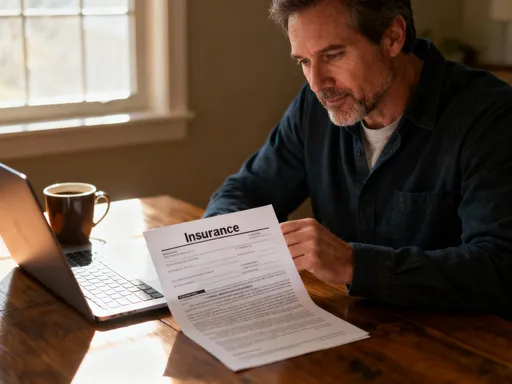

The call came on a Tuesday morning. A routine test had revealed something serious — a condition requiring immediate treatment and months of recovery. In an instant, my world shifted. The doctor spoke of procedures, specialists, and recovery timelines, but my mind raced toward another reality: my finances. I was self-employed, with no paid sick leave. My income, once steady, now faced an uncertain pause. And the bills — even with insurance — began to pile up faster than I could process them.

Within weeks, I was facing medical expenses that exceeded my annual emergency fund. Co-pays, prescriptions, travel to specialists, and home modifications for recovery added up quickly. I hadn’t planned for a scenario where both income stopped and costs surged simultaneously. My investment accounts, once symbols of long-term security, now felt like untouchable vaults — accessing them could trigger taxes or penalties. The emotional toll was just as heavy. Anxiety about money made it harder to focus on healing. I felt trapped between needing money and fearing the consequences of using what I had.

This experience exposed a critical flaw in my financial planning: I had optimized for growth, not resilience. I had diversified across stocks and funds, maximized retirement contributions, and celebrated annual returns — but I hadn’t built a system that could function when I couldn’t. The market downturns I’d prepared for were abstract. A personal health crisis was different. It wasn’t about portfolio volatility; it was about survival. That distinction changed everything. I realized that true financial strength isn’t measured by peak balances, but by how well your plan holds up when life goes off track.

Rethinking Investment Goals: From Growth to Stability

Before my diagnosis, my investment mindset was straightforward: aim for long-term growth. I believed in compound interest, market recovery, and staying the course. But when illness hit, that philosophy no longer served me. The idea of waiting 10 or 20 years for a rebound felt irrelevant when I needed stability now. I began to question the very purpose of my investments. Were they only for retirement, or were they also meant to protect me during life’s interruptions?

I shifted my focus from maximizing returns to preserving capital. This wasn’t a surrender; it was a recalibration. Growth is essential, but only when you have the time and stability to endure risk. During a health crisis, the priority becomes avoiding losses that could permanently derail recovery. Selling investments at a market low to cover expenses would have locked in losses — a mistake that could take years to recover from. By shifting to a stability-first mindset, I protected my assets from forced liquidation.

This change also reduced emotional strain. When your health is fragile, financial stress can feel unbearable. Knowing that my portfolio wasn’t swinging wildly gave me peace of mind. I no longer checked stock prices daily. Instead, I focused on what mattered: having enough accessible, reliable money to cover my needs without panic. This doesn’t mean abandoning growth entirely. It means recognizing that financial goals are dynamic. In times of crisis, stability isn’t a detour — it’s a necessary foundation for any future growth.

Building a Crisis-Ready Portfolio: The Core Principles

A crisis-ready portfolio isn’t built on exotic strategies or high-risk bets. It’s built on three practical pillars: liquidity, low volatility, and income generation. These principles aren’t about chasing returns; they’re about creating a financial buffer that works when you can’t. Together, they form a structure that reduces the need for desperate decisions during emergencies.

Liquidity is the first and most urgent need. When medical bills arrive, you can’t wait for assets to mature or markets to recover. I learned to keep a portion of my savings in easily accessible accounts — high-yield savings, money market funds, and short-term certificates of deposit. These offer modest returns but near-instant access. During my recovery, this liquidity covered three months of expenses without touching my brokerage accounts. That alone prevented a cascade of tax consequences and emotional distress.

Low-volatility assets form the second pillar. I replaced some of my high-growth equities with investment-grade bonds, dividend-paying blue-chip stocks, and balanced funds. These don’t deliver explosive returns, but they’re less likely to plunge during market stress. More importantly, they’re less tempting to sell in a panic. When your health is compromised, emotional decision-making is a real danger. A stable portfolio reduces the urge to react impulsively to short-term fluctuations.

The third principle is automatic income. I restructured part of my portfolio to generate regular cash flow — through bond interest, dividends, and rental income from a small property I owned. This wasn’t about replacing my full income, but about covering essential costs like insurance premiums, utilities, and medication. Knowing that money would arrive monthly, regardless of my ability to work, gave me a sense of control. These three elements — liquidity, stability, and income — didn’t make me rich. But they kept me secure when I needed it most.

Emergency Funds vs. Investment Accounts: Where to Pull From First

When you’re facing a medical crisis, every financial decision carries weight. One of the most critical is knowing where to access money — and in what order. I quickly realized that tapping the wrong account could do long-term damage. Withdrawing from retirement accounts early, for example, triggers taxes and penalties. Selling stocks at a loss locks in that loss permanently. I needed a clear hierarchy for accessing funds — a withdrawal ladder that minimized cost and preserved future wealth.

My first step was to use my emergency fund. I had saved eight months of living expenses in a high-yield savings account, specifically for unforeseen events. This wasn’t part of my investment portfolio — it was separate, liquid, and penalty-free. Drawing from this fund allowed me to cover immediate costs without disrupting my long-term assets. It also gave me time to assess my situation without rushing into irreversible decisions.

Once my emergency fund was partially depleted, I turned to my taxable brokerage account. Unlike retirement accounts, these allow withdrawals at any time without penalties. I focused on selling assets that had appreciated the least or were already generating income, minimizing capital gains taxes. I avoided selling holdings that were down in value, waiting instead for a recovery. This discipline prevented me from locking in losses during a vulnerable period.

I only considered retirement accounts as a last resort. Withdrawing from a traditional IRA or 401(k) before age 59½ typically incurs a 10% penalty plus income tax. Even under hardship rules, the cost is high. I explored whether I qualified for exceptions — such as the medical expense deduction — but found the thresholds strict. Instead of raiding these accounts, I adjusted my budget and extended my timeline for accessing them. This restraint preserved the compounding potential of those funds. The order of withdrawal — emergency savings first, taxable accounts second, retirement last — became a financial safeguard that protected both my present and my future.

Automating Finances: How Systems Prevent Mistakes Under Stress

When you’re unwell, even simple tasks can feel overwhelming. Remembering due dates, tracking expenses, or rebalancing a portfolio can become impossible. I discovered that the best protection wasn’t just in my account balances — it was in the systems I had in place. Automation became my silent partner in financial survival. By setting up automatic payments, transfers, and monitoring tools, I reduced the mental load and avoided costly oversights.

I began with bill payments. Every essential expense — mortgage, insurance, utilities, and subscriptions — was scheduled for automatic withdrawal from a dedicated checking account. This eliminated the risk of late fees or service interruptions. It also meant I didn’t have to make decisions when I lacked energy. Even during the hardest weeks, my obligations were met without effort. I also automated transfers to my emergency fund, ensuring it would replenish once I returned to work.

Portfolio management was another area I automated. I set up rules-based rebalancing through my brokerage, which adjusted my asset allocation if it drifted beyond target ranges. This prevented emotional overreactions to market swings. I also used budgeting software that synced with my accounts, providing real-time insights into spending and cash flow. Alerts notified me of unusual activity, helping me catch errors or fraud quickly.

These systems didn’t just save time — they preserved discipline. When stress clouds judgment, automation acts as a guardrail. It ensures that sound decisions made in calm moments continue to work when you’re not at your best. For someone managing illness, this kind of structure isn’t a luxury; it’s a necessity. It transforms financial management from a source of anxiety into a source of stability.

Working with Advisors: When to Ask for Help

I didn’t make these changes alone. Early in my recovery, I reached out to a fee-only financial planner — someone with no incentive to sell me products, only to provide objective advice. That decision changed my trajectory. An outside perspective helped me see beyond my immediate fears and make rational, long-term choices. The advisor reviewed my entire financial picture — income, expenses, assets, insurance, and goals — and helped me adjust my strategy without emotion.

One of the most valuable things we did was stress-test my portfolio. We modeled different scenarios: What if recovery took longer? What if I couldn’t return to full-time work? These exercises revealed gaps in my planning and led to concrete adjustments — like increasing my emergency fund target and diversifying income sources. The advisor also helped me understand tax implications I had overlooked, such as the difference between short-term and long-term capital gains when selling investments.

Choosing the right advisor was key. I looked for someone with experience in life-event planning, not just investment management. I wanted someone who understood how health, insurance, and cash flow intersect. We met regularly, even during my treatment, using video calls when in-person visits weren’t possible. Clear communication was essential. I shared my health status honestly, so recommendations were grounded in reality. This partnership didn’t eliminate my challenges, but it gave me confidence that I wasn’t making decisions in the dark.

Seeking help isn’t a sign of failure — it’s a sign of wisdom. When your capacity is limited, professional guidance can prevent costly mistakes. Whether it’s a financial planner, tax advisor, or insurance specialist, the right support can make your plan more resilient. And for someone focused on healing, that peace of mind is invaluable.

Long-Term Recovery: Rebuilding Confidence and Wealth

Recovery didn’t happen overnight. As my health improved, I began to think about the future again. But I didn’t rush back to my old investment habits. Instead, I adopted a phased approach to rebuilding. I started by reassessing my risk tolerance. The experience had changed my perspective — I was more cautious, and that was okay. I didn’t need to prove I could handle volatility; I needed a plan that supported my well-being.

I gradually reintroduced growth-oriented investments, but in a controlled way. I used dollar-cost averaging to buy into diversified index funds over several months, reducing the impact of market timing. I also revisited my insurance coverage, adding a disability policy to protect against future income loss. These steps weren’t about catching up — they were about building a more balanced, sustainable strategy.

One of the most important shifts was in my mindset. I no longer saw financial planning as a separate task from life planning. My portfolio wasn’t just a number — it was a tool for security, flexibility, and peace of mind. I began to measure success not just by returns, but by resilience. Could my plan withstand another shock? Could it support me if I needed to reduce my workload? These questions guided my decisions more than any market forecast.

Today, I’m stronger — both physically and financially. The crisis didn’t destroy my wealth; it refined it. I’ve rebuilt my emergency fund, restored my portfolio balance, and gained a deeper understanding of what true financial security means. I’m not invulnerable, but I’m prepared. And that makes all the difference.

A Smarter Way to Invest for Life’s Surprises

Sudden illness exposed the weaknesses in my financial plan — but it also led to a more thoughtful, sustainable approach. I learned that investing isn’t just about building wealth; it’s about building resilience. The goal isn’t to predict every crisis, but to create systems that endure them. By prioritizing protection, liquidity, and emotional stability, I developed a strategy that supports both my financial and personal well-being.

This experience taught me that flexibility is as important as discipline. A rigid plan may work in stable times, but it can fail when life changes. The most effective strategies are those that adapt — shifting from growth to preservation when needed, then back again. They rely on structure, not willpower. Automation, clear withdrawal rules, and professional guidance make it possible to stay on track even under pressure.

For anyone managing a household, caring for family, or building a future, this lesson is vital. Financial security isn’t just for the healthy or the employed. It’s for everyone — especially those facing unexpected challenges. You don’t need perfect health to have a strong financial plan. You need clarity, preparation, and the courage to adjust when life demands it. By designing your investments to withstand disruption, you’re not just protecting money — you’re protecting your peace, your dignity, and your ability to heal. That’s the true measure of financial success.