How I Keep My Money Safe Without Killing Returns

What if you could protect your money without sacrificing growth? I used to think safety meant boring returns—until I learned smarter ways to balance both. After nearly losing savings during a market dip, I redesigned my strategy around stability. It’s not about hiding cash under the mattress. It’s about intentional choices that cushion risk while still earning. Here’s how I structure my portfolio to stay calm when markets go wild.

The Moment Everything Changed

The wake-up call came on an ordinary Tuesday morning. I was making coffee, glancing at my phone, when a red alert flashed across my investment app: portfolio down 18% in one week. My stomach dropped. This wasn’t just a number—it was years of careful saving, vacation funds, and my children’s future staring back at me, suddenly diminished. I had always considered myself a responsible saver, but I’d unknowingly loaded up on high-flying tech stocks and trendy ETFs, lured by stories of fast gains. I told myself I was being smart, taking calculated risks. But when volatility hit, I realized I had no real plan for surviving a downturn.

That moment changed everything. I wasn’t angry at the market—I was disappointed in myself. I had focused so much on how much I could earn that I hadn’t asked how much I could afford to lose. The emotional toll was real. I found myself checking my balance multiple times a day, jumping at every headline. I started questioning every financial decision I’d ever made. Sleep became harder. My confidence in managing money, once steady, began to erode. I knew I needed a new approach—one that didn’t leave me feeling helpless when the market turned.

What I learned in the months that followed reshaped my entire mindset. I began studying financial resilience, not just returns. I read about investors who had weathered crashes, recessions, and bear markets without losing their life savings. A common thread emerged: they weren’t chasing the highest returns. They were designing portfolios to survive. That distinction was revolutionary for me. I realized that true financial progress isn’t measured by how high your account balance climbs during good times, but by how intact it remains when things go wrong. Protecting capital isn’t conservative—it’s strategic. And from that point on, my goal shifted: I wanted growth, but only if it didn’t come at the cost of peace of mind.

What Asset Preservation Really Means

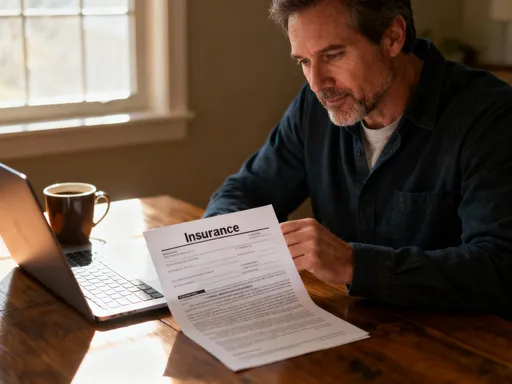

When most people hear “asset preservation,” they picture cash stuffed in a safe or low-interest savings accounts. But in reality, true asset preservation is far more dynamic. It means structuring your investments so that they can withstand shocks without derailing your long-term goals. It’s not about eliminating risk entirely—that’s impossible. Instead, it’s about managing risk wisely, so that no single event can wipe out years of progress. Think of it as building a home with a strong foundation, quality materials, and storm-resistant windows. You’re not trying to avoid every storm—you’re making sure the house still stands when the wind blows.

This concept sits between two extremes: aggressive growth and extreme conservatism. On one end, aggressive investors chase high returns, often accepting high volatility as the price of entry. On the other, ultra-conservative savers avoid all risk, sometimes missing out on inflation-beating returns. Asset preservation occupies the middle ground—a balanced approach that acknowledges the need for growth while respecting the importance of stability. It’s especially crucial for people in their 30s to 50s, who may be saving for college, paying off mortgages, or preparing for retirement. These aren’t abstract goals; they’re life milestones that depend on reliable financial progress.

Consider this scenario: two investors each start with $100,000. Over ten years, both earn an average annual return of 6%. But Investor A experiences steady growth, while Investor B faces wild swings—a 20% loss one year, a 30% gain the next. Despite the same average, Investor A ends up with more money due to the compounding effect of avoiding large drawdowns. Why? Because losing 20% requires a 25% gain just to break even. Big losses create a compounding penalty. Asset preservation helps avoid that trap. It’s not about avoiding all volatility, but about reducing the impact of severe drops that can force people to sell low or abandon their plans altogether.

Why Return Stability Beats Flashy Gains

At first glance, a 7% average return sounds better than 5%. But averages can be misleading. What matters more is the path your money takes to get there. A stable 5% return compounds predictably, allowing your wealth to grow steadily over time. A volatile 7% return, on the other hand, might include years of steep losses that take years to recover from. This is where many investors get tripped up. They focus on headline returns without considering the emotional and financial cost of volatility.

Let’s break it down with a simple example. Suppose you invest $50,000. With a stable 5% annual return, compounded, you’d have about $81,445 after ten years. Now imagine an alternative path: an average of 7%, but with extreme swings—a 30% loss in year one, a 40% gain in year two, and so on. Even if the math averages out, the sequence of returns heavily impacts your final balance. A major early loss means you have less capital to grow in the following years. In practice, the volatile portfolio might end up with less than the steady one, despite the higher average. This is known as sequence-of-returns risk, and it’s a hidden danger for long-term savers.

Beyond the math, there’s a psychological component. When your portfolio drops sharply, it’s hard to stay calm. Many people panic and sell at the worst possible time, locking in losses. Others stop contributing, afraid of losing more. Emotional stability is just as important as financial stability. A smoother investment journey makes it easier to stay the course. That’s why I prioritize consistency. I’d rather earn a reliable return I can count on than chase a higher number that keeps me up at night. Over time, that discipline pays off—not just in dollars, but in confidence.

My Core Allocation Strategy

My portfolio isn’t built for excitement. It’s built for endurance. At its core is a diversified mix of asset classes designed to reduce dependence on any single market or sector. I divide my investments into three main buckets: low-volatility holdings, income-generating assets, and selective growth positions. Each plays a distinct role, and together, they create a system that can adapt to different economic conditions.

The first bucket, low-volatility holdings, makes up about 40% of my portfolio. These include high-quality bonds, dividend-paying blue-chip stocks, and index funds focused on stable industries like utilities and consumer staples. These assets don’t skyrocket in bull markets, but they also don’t collapse during downturns. They provide a stabilizing force, helping to smooth out overall portfolio swings. I think of them as the foundation of a house—not glamorous, but essential.

The second bucket, income-generating assets, accounts for 30%. This includes bond funds, real estate investment trusts (REITs), and dividend-focused exchange-traded funds. The goal here isn’t rapid appreciation, but steady cash flow. These investments pay me regularly, which I can reinvest or use to cover living expenses. This income acts as a cushion, reducing the need to sell assets during market dips. It also creates a sense of progress—seeing dividends arrive each quarter reminds me that my money is working, even when prices aren’t rising.

The final 30% is allocated to selective growth opportunities. This includes broad-market index funds and a small portion in sector-specific ETFs with strong long-term potential, like healthcare and renewable energy. I limit this portion deliberately, so that strong performance doesn’t tempt me to overcommit. These assets provide upside potential, but they’re balanced by the stability of the other two buckets. Geographic and sector diversification further reduce risk—I hold assets across North America, Europe, and emerging markets, avoiding overexposure to any single economy.

Risk Control Tactics That Actually Work

Diversification is important, but it’s not enough on its own. I’ve built several layers of protection into my strategy to manage risk actively. One of the most effective is regular rebalancing. Every six months, I review my portfolio and adjust the allocations back to their target levels. If one asset class has grown too large, I sell a portion and reinvest in underweight areas. This forces me to “sell high and buy low” automatically, without having to time the market. It feels counterintuitive at times—selling what’s performing well—but it’s a proven way to control risk and maintain discipline.

Another key tactic is maintaining a cash reserve. I keep six to twelve months of living expenses in a high-yield savings account, separate from my investment portfolio. This serves multiple purposes. First, it eliminates the need to sell investments during a downturn to cover emergencies. Second, it gives me the flexibility to take advantage of buying opportunities when prices are low. Most importantly, it reduces anxiety. Knowing I have a financial buffer makes it easier to stay calm when markets are volatile.

I also rely on mental frameworks to avoid emotional decisions. One rule I follow is the “three-day rule”: before making any major change to my portfolio, I wait 72 hours. This simple pause helps me distinguish between a thoughtful decision and a reactive impulse. I also avoid checking my account daily. Instead, I review performance quarterly. This prevents me from overreacting to short-term noise. These aren’t flashy strategies, but they’re practical, repeatable, and effective. They turn risk management into a habit, not a crisis response.

Real Trade-Offs and What I Gave Up

No strategy is perfect, and mine comes with real trade-offs. The most noticeable is slower growth during strong bull markets. When tech stocks soar or meme stocks grab headlines, my portfolio doesn’t keep pace. I’ve had friends boast about doubling their money in a year, while mine creeps forward at a modest pace. There’s a natural temptation to envy those returns, to wonder if I’m being too cautious. I won’t pretend those moments don’t sting.

But I’ve learned to measure success differently. I don’t judge my progress by how fast I’m catching up to others. I measure it by how well I sleep at night. I ask myself: Can I handle a 20% market drop without panic? Can I stick to my plan when others are selling? Can I still afford my goals even if the economy slows? The answer, more often than not, is yes. That consistency has value—a value that compounds over time, not just in wealth, but in confidence and control.

I also gave up the excitement of chasing hot trends. I don’t invest in cryptocurrencies, speculative startups, or leveraged ETFs. I don’t day-trade or follow market gurus on social media. These choices might seem boring, even passive. But I see them as protective. Every financial decision is a trade-off between potential reward and potential regret. I’ve chosen a path that minimizes the latter. I’d rather look back in ten years and say, “I didn’t get rich overnight, but I never lost what mattered,” than face the opposite.

Building a Portfolio That Sleeps-Well-at-Night

In the end, my approach isn’t about maximizing returns. It’s about building a financial life that feels secure, sustainable, and aligned with my values. I’ve come to see my portfolio not as a scoreboard, but as a safety net. Its purpose isn’t to make me the richest person I know, but to ensure I can meet my responsibilities, support my family, and face the future without fear. That shift in perspective has been transformative.

Return stability isn’t about avoiding risk altogether. It’s about designing a system that can absorb shocks and keep moving forward. It’s about making intentional choices today so I don’t have to make desperate ones tomorrow. I’ve learned that the most powerful financial tool isn’t a high-return stock or a secret strategy—it’s peace of mind. When markets are calm, that peace lets me focus on life, not balances. When markets are turbulent, it keeps me from making irreversible mistakes.

I still aim for growth. I still believe in the power of compounding and long-term investing. But now, I pursue those goals with a framework that prioritizes resilience. I diversify across assets, rebalance regularly, keep cash on hand, and stay emotionally grounded. These aren’t one-time fixes—they’re habits, practiced over time. And slowly, steadily, they’ve built something far more valuable than a high account balance: confidence. Because in the end, the best return isn’t measured in percentages. It’s measured in the quiet certainty that no matter what happens, I’ll be okay.