How I Protect My Portfolio Without Losing Sleep

What if a lawsuit could wipe out everything you’ve built? I never thought about it—until a friend got hit with a massive liability claim. That’s when I realized: no investment strategy works if you don’t protect what you already have. Liability insurance isn’t just for doctors or CEOs. If you own assets, drive a car, or host guests, you’re at risk. A single accident—someone slipping on your sidewalk, a minor collision during a weekend trip, or even a social media comment misinterpreted as defamation—can spiral into legal action. And if you’ve spent years building retirement accounts, saving for your children’s education, or investing in real estate, all of that can be vulnerable. This is how I integrated real risk protection into my investment portfolio—and why it changed everything. It wasn’t about chasing higher returns. It was about ensuring that the wealth I worked so hard to grow wouldn’t vanish overnight due to something entirely out of my control. The truth is, the most sophisticated portfolio means little without a strong defense. That defense starts with understanding and acting on liability risk.

The Wake-Up Call: When Risk Hit Close to Home

The first time I truly considered liability risk, it wasn’t through a financial article or an insurance brochure. It was through a close friend’s personal crisis. She was a schoolteacher, married, with two children, and had worked diligently for over two decades to build a modest but stable life. She owned a home, had savings, and was on track with her retirement goals. One weekend, while hosting a small family gathering in her backyard, a guest tripped over a garden hose she hadn’t noticed and fell, breaking her arm and sustaining a minor head injury. What began as a simple accident escalated quickly. The guest, represented by an aggressive legal team, filed a personal injury lawsuit seeking $850,000 in damages. My friend’s homeowner’s insurance covered $300,000, but that left a $550,000 gap. The court ruled in favor of the plaintiff, and my friend was personally liable for the remainder. To settle the judgment, she had to liquidate investments, refinance her home at a higher rate, and delay her retirement by nearly ten years. Watching someone I cared about endure that emotional and financial toll was a turning point. I realized that her story wasn’t unique. People like her—responsible, cautious, not wealthy by elite standards—are often the most vulnerable because they assume their standard insurance is sufficient. They don’t see the legal exposure until it’s too late. That moment shifted my entire perspective on wealth management. I had been focused on portfolio diversification, tax efficiency, and long-term growth—but I hadn’t fully accounted for the risk of losing it all in a single event. The lesson was clear: protecting your assets isn’t secondary to investing. It’s foundational.

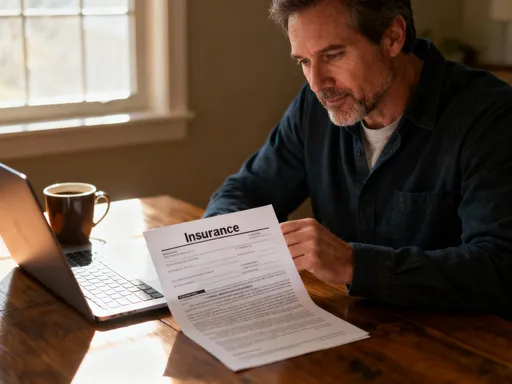

What Liability Insurance Really Is (And What It Isn’t)

Likely the most misunderstood aspect of personal finance, liability insurance is often confused with other types of coverage. At its core, liability insurance protects you financially if you are found legally responsible for someone else’s injury or property damage. It covers legal defense costs, settlements, and court-ordered judgments, up to the policy limit. For example, if a delivery person slips on your icy driveway and sues, liability insurance would step in to handle the legal and financial consequences. This is different from property insurance, which covers damage to your own belongings, or health insurance, which pays for your medical expenses. Liability coverage is not about your own losses—it’s about the harm you might unintentionally cause to others. Common scenarios include car accidents where you are at fault, injuries on your property, or even off-premises incidents like a dog bite during a walk in the park. However, it’s equally important to understand what liability insurance does not cover. It typically excludes intentional acts, business-related claims unless you have separate commercial coverage, and damages from criminal behavior. It also does not cover contractual liabilities or damage to your own property. Many people assume that because they are careful, they are safe. But the legal system doesn’t always care about intent—it cares about responsibility. A spilled drink on a hardwood floor that leads to a fall, a child’s playdate accident, or even a mistaken social media post about a neighbor’s property boundary can become grounds for a claim. The key insight is that liability insurance isn’t about admitting fault; it’s about having a financial buffer when life goes unpredictably wrong. Without it, you are personally exposed to lawsuits that could reach into your savings, investments, and future earnings. For families, this risk is even greater, as the potential for accidents involving children, guests, or vehicles increases. Recognizing the scope and limits of liability insurance is the first step toward integrating it into a comprehensive financial plan.

Why Your Investment Portfolio Needs This Safety Net

Many investors focus on returns, fees, and market timing—but few consider how vulnerable their portfolio is to external legal threats. The truth is, your brokerage account, real estate holdings, retirement funds, and even future wages are all potential targets in a liability lawsuit. If a judgment exceeds your insurance coverage, creditors can seek asset seizure, wage garnishment, or liens on property. This means that years of disciplined saving and strategic investing could be undone in months. Imagine contributing consistently to a 401(k) for two decades, only to see a portion of it at risk because of an unforeseen accident. Or picture building equity in a rental property, only to face a lawsuit from a tenant injured on the premises. These are not hypotheticals—they happen regularly. The connection between liability risk and investment success is direct: without protection, your portfolio is exposed to total or partial loss regardless of performance. Consider this scenario: you have a $750,000 net worth, including a home, investment accounts, and a retirement fund. You are involved in a car accident where you are deemed at fault, resulting in serious injuries to the other party. The resulting lawsuit seeks $1.2 million in damages. Your auto insurance liability limit is $300,000—the standard in many states. Without additional coverage, you are personally responsible for the remaining $900,000. Courts can order the liquidation of investment accounts, place liens on real estate, or garnish future income to satisfy the judgment. In this case, even a well-diversified, high-performing portfolio offers no protection. The financial loss isn’t just immediate—it can derail long-term goals like retirement, education funding, or legacy planning. This is why liability insurance must be viewed not as a peripheral cost, but as a structural component of wealth preservation. Just as you wouldn’t build a house without a foundation, you shouldn’t grow wealth without safeguards. The goal of investing isn’t just to accumulate—it’s to retain. And retention requires anticipating risks that lie outside the market, such as legal liability. By integrating liability protection into your financial strategy, you ensure that your portfolio isn’t just growing, but also guarded against preventable collapse.

The Hidden Gap Most Investors Ignore

One of the most common misconceptions in personal finance is the belief that standard insurance policies offer comprehensive protection. Homeowner’s, renter’s, and auto insurance policies do include liability coverage, but the limits are often far below what a serious claim could demand. For instance, a typical homeowner’s policy might provide $300,000 in liability coverage, while auto policies may offer $100,000 to $300,000 per person. In today’s litigious environment, these amounts can be exhausted quickly. Medical costs for serious injuries can exceed $500,000, and non-economic damages like pain and suffering are often awarded in the hundreds of thousands or even millions. When the claim surpasses your policy limit, you are personally on the hook for the difference. This is the hidden gap. Many families never realize they are underinsured until it’s too late. Take the case of a couple in suburban Ohio who hosted a holiday party. A guest, after drinking at the event, drove home and caused a fatal accident. The victim’s family sued the hosts under social host liability laws. The claim exceeded $1.5 million. Their homeowner’s policy covered $300,000, but without additional protection, they faced a $1.2 million judgment. Their retirement accounts and home equity were at risk. This is where umbrella insurance becomes critical. An umbrella policy provides an extra layer of liability coverage, typically starting at $1 million and going up to $5 million or more, for a relatively low annual premium—often between $150 and $300 for $1 million in coverage. It acts as a follow-on policy, kicking in when your primary insurance is exhausted. It covers a wide range of scenarios, including personal injury, libel, slander, and even some international incidents. The cost-benefit ratio is compelling: for less than $10 a week, you can significantly reduce the risk of financial ruin. Yet, surveys show that fewer than 15% of American households carry an umbrella policy. The reason isn’t usually cost—it’s lack of awareness. Investors who meticulously track portfolio allocations often overlook this simple, high-impact safeguard. Closing the gap doesn’t require complex strategies. It starts with recognizing that standard policies are a starting point, not a finish line.

How to Match Coverage to Your Financial Reality

Determining the right level of liability protection isn’t about following a one-size-fits-all rule—it’s about aligning coverage with your personal financial profile. The first step is assessing your net worth, including savings, investments, real estate, and future income potential. As a general guideline, financial advisors often recommend that your umbrella policy should at least match your net worth. If you have $800,000 in assets, a $1 million umbrella policy provides a reasonable buffer. But net worth is only part of the picture. Lifestyle factors matter just as much. Do you own a home with a swimming pool or trampoline? These features increase liability risk. Do you frequently host guests, drive long distances, or travel with children? Each of these activities raises exposure. Do you serve on a nonprofit board or have a public-facing profession? You may face higher risks of defamation or negligence claims. Even owning certain dog breeds can influence your risk profile in some states. Another consideration is future earnings. If you are in your peak earning years, a lawsuit could target not just current assets but future income. A young professional with a high salary trajectory may need more protection than someone with the same net worth but nearing retirement. Families with children also face unique risks—school events, sports activities, and social gatherings all create potential liability scenarios. The goal is not to live in fear, but to be realistically prepared. A practical way to evaluate your needs is to ask a series of questions: Could a single accident lead to a claim exceeding $500,000? Do I have assets that could be targeted in a lawsuit? Am I comfortable with the possibility of defending myself in court without robust coverage? If the answer to any of these is yes, additional liability protection is worth considering. The process doesn’t have to be overwhelming. Start with a conversation with your insurance agent. Review your current policies, identify coverage limits, and discuss whether an umbrella policy makes sense. Many insurers offer discounts for bundling, so having auto and home insurance with the same provider can reduce the cost of adding umbrella coverage. The key is to treat this assessment as a routine part of financial planning, just like rebalancing your portfolio or reviewing retirement contributions.

Smart Integration: Insurance as a Financial Tool, Not Just a Cost

One of the biggest mental shifts in personal finance is viewing insurance not as an expense, but as a strategic tool for wealth preservation. Too often, liability coverage is seen as a necessary evil—a line item on an insurance bill with no immediate return. But when framed correctly, it becomes a powerful enabler of financial confidence and long-term growth. Consider the cost of a $1 million umbrella policy: approximately $200 per year. Now compare that to the potential cost of a $750,000 judgment. Even if you win the case, legal fees can exceed $100,000. The financial impact of litigation—stress, time, and distraction—can also affect your ability to manage investments, run a business, or maintain employment. In this light, liability insurance is not a cost; it’s risk mitigation with a high return on protection. It allows you to invest more confidently, knowing that a single event won’t derail your financial plan. It supports peace of mind, which in turn leads to better decision-making. When you’re not constantly worried about worst-case scenarios, you’re more likely to stick to long-term strategies, avoid emotional reactions to market swings, and maintain consistent contributions to retirement accounts. This psychological benefit is often overlooked but deeply valuable. Moreover, having robust liability coverage can influence other financial decisions. For example, if you’re considering purchasing a rental property, knowing you have strong liability protection may make the investment feel less risky. Similarly, if you’re planning to start a side business from home, umbrella insurance can provide an added layer of security. Some policies even cover incidents abroad, which is valuable for frequent travelers. The integration of liability protection into a financial plan isn’t about eliminating risk—that’s impossible. It’s about managing it intelligently. Just as diversification reduces market risk, liability insurance reduces legal risk. Both are essential components of a resilient portfolio. When you view insurance as part of your financial architecture, rather than a separate expense, you begin to see it as an investment in stability. And stability is the foundation of lasting wealth.

Taking Action Without Overcomplicating It

Knowing you need liability protection is one thing; taking action is another. The good news is that adding an umbrella policy doesn’t require a financial overhaul or hours of research. The process can be simple and straightforward. Start by reviewing your current insurance policies—home, auto, and any others that include liability coverage. Note the limits for each. Then, contact your insurance provider and ask whether they offer umbrella policies and what the requirements are. Most companies require a minimum level of underlying coverage—such as $250,000 on auto and $300,000 on home—before issuing an umbrella policy. If you don’t meet those thresholds, you may need to adjust your primary coverage first. Once you’re eligible, the application process usually involves a basic risk assessment, including questions about your property, vehicles, and claims history. Some insurers may check your credit or driving record, but the underwriting is generally not invasive. Premiums are based on risk factors, but for most middle-income households, the cost remains low. If your current insurer doesn’t offer competitive rates, shop around. Many national providers offer umbrella policies, and independent agents can help compare options. The entire process—from review to purchase—can take less than a week. There’s no need to overanalyze or delay. Even if you start with $1 million in coverage, you can always increase it later as your net worth grows. The most important step is the first one: acknowledging that protection matters. You don’t need to become an insurance expert. You just need to take a few deliberate actions to close the gap. And once it’s in place, you can return to focusing on your investment goals with greater confidence. This isn’t about fear-mongering. It’s about empowerment. By taking simple, informed steps, you build a financial life that is not only growing but also resilient.

Building Wealth Is a Marathon—Don’t Skip the Guardrails

True financial success isn’t measured solely by returns or net worth. It’s measured by sustainability—how well you preserve what you’ve earned over time. Investing is essential, but it’s only half the equation. The other half is protection. Without it, even the most disciplined portfolio can be vulnerable to forces beyond market volatility. Liability insurance may not generate returns, but it prevents catastrophic losses. It acts as the guardrail on the financial highway—unseen most of the time, but invaluable when you need it. For families, it offers peace of mind, knowing that a single mistake won’t erase decades of hard work. For long-term planners, it ensures that retirement, education, and legacy goals remain on track. The best investment strategies aren’t just about playing to win. They’re about playing not to lose. And that requires balance. By integrating liability protection into your financial plan, you’re not just managing risk—you’re enabling growth. You’re creating a foundation where wealth can compound without the threat of sudden reversal. In the end, the goal isn’t just to accumulate, but to keep. And keeping requires foresight, preparation, and a commitment to comprehensive planning. That’s how you build wealth that lasts—not just for you, but for future generations. So before you adjust your asset allocation or research the next hot stock, take a moment to review your liability coverage. It might be the most important financial decision you make all year.