How I Keep My Money Safe While Growing It — Real Talk on Smarter Investing

What if you could grow your wealth without losing sleep over market swings? I’ve been there—excited by gains, then terrified by sudden drops. Over time, I learned that protecting what you have is just as crucial as chasing returns. This isn’t about get-rich-quick schemes. It’s about practical steps that balance growth and safety. Let me walk you through how everyday investors can build resilience, avoid common traps, and make their money work smarter. Investing should feel empowering, not exhausting. With the right approach, you can aim for returns while keeping your peace of mind intact. This is real talk on building lasting financial strength.

The Wake-Up Call: Why Growth Isn’t Enough

For years, I believed that the sole measure of a successful investment was how high the returns climbed. I watched stock prices with excitement, celebrated quarterly gains, and compared my portfolio performance to others. But that mindset changed dramatically after a single turbulent year in the markets. What started as a modest downturn turned into a steep correction, and I watched helplessly as nearly 25% of my portfolio value disappeared in just a few months. It wasn’t just the financial loss that shook me—it was the emotional toll. I began questioning every decision, second-guessing my strategy, and losing confidence in my ability to manage my own money. That experience was a wake-up call: growth without protection is fragile.

Many investors fall into the same trap—focusing exclusively on return potential while underestimating risk. They chase high-performing stocks, jump into trending sectors, or pile into speculative assets, often without understanding what could go wrong. The allure of quick profits is powerful, especially when media coverage highlights overnight success stories. But history shows that markets move in cycles, and periods of rapid growth are often followed by corrections. Without a strategy to preserve capital, those gains can evaporate quickly. The real goal of investing isn’t just to earn returns—it’s to keep them. That means building a foundation that can withstand market volatility, economic shifts, and unexpected personal circumstances.

What I learned from my setback was the importance of balance. A portfolio that delivers steady, moderate returns with lower risk is often more valuable in the long run than one with explosive highs and devastating lows. Volatility doesn’t just affect account balances—it affects behavior. When people see their investments drop sharply, they’re more likely to sell in panic, locking in losses and missing the recovery. This emotional response is one of the biggest obstacles to long-term wealth building. By shifting my focus from pure growth to a combination of growth and protection, I started making more thoughtful decisions. I stopped reacting to short-term noise and began building a strategy that prioritized sustainability over speed.

Asset Allocation: Your Financial Backbone

If there’s one principle that transformed my investing journey, it’s asset allocation. This isn’t a complicated financial term reserved for experts—it’s simply the way you divide your money among different types of investments. Think of it as the blueprint of your financial house. Just as a strong foundation supports a stable structure, a well-constructed asset allocation supports a resilient portfolio. Before I understood this, I had most of my money in individual stocks, believing that picking the right companies was the key to success. But when the market turned, my entire portfolio moved in the same direction—down. That’s when I realized I needed balance.

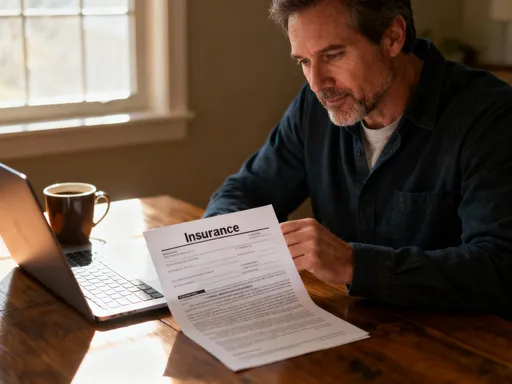

Asset allocation typically involves spreading investments across major categories: stocks, bonds, and cash equivalents. Each plays a different role. Stocks offer growth potential over time, making them essential for long-term goals like retirement. Bonds tend to be less volatile and can provide income through interest payments, helping to cushion losses when stocks decline. Cash and cash equivalents—like savings accounts or money market funds—offer stability and immediate access to funds, which is useful during emergencies or market downturns. The right mix depends on several factors, including your age, financial goals, time horizon, and how much risk you’re comfortable taking.

For example, someone in their 30s saving for retirement might have a higher allocation to stocks—perhaps 70% or more—because they have decades to ride out market fluctuations. In contrast, someone nearing retirement might shift toward bonds and cash to protect their savings from volatility. The key is not to guess the perfect mix but to create a strategy that aligns with your life situation. Once you’ve set your allocation, it’s not a one-time decision. Markets change, your goals evolve, and your risk tolerance may shift. That’s why regular reviews—once a year or after major life events—are essential. Rebalancing your portfolio ensures that you don’t drift too far from your original plan, keeping your risk level consistent over time.

Over the years, I’ve found that a balanced allocation doesn’t just reduce risk—it also improves long-term results. While it’s tempting to chase the highest returns, a diversified mix often performs more reliably across different market conditions. It won’t make you the biggest winner during a bull market, but it also won’t leave you devastated in a downturn. That consistency is what builds real wealth over time.

Diversification Done Right: Beyond Just “Don’t Put All Eggs in One Basket”

I used to think I was diversified because I owned several different stocks. Then I realized they were all in the same sector—technology. When that sector faced a broad sell-off, my so-called diversified portfolio dropped almost as sharply as if I’d invested in just one company. That was a hard lesson: true diversification goes far beyond owning multiple investments. It means spreading your money across different asset classes, industries, geographic regions, and investment styles so that a downturn in one area doesn’t drag down your entire portfolio.

Effective diversification starts with understanding correlation—the degree to which different investments move in relation to each other. If two assets are highly correlated, they tend to rise and fall together, offering little protection when markets decline. The goal is to combine assets that don’t move in lockstep. For example, when U.S. stocks struggle, international markets might perform better. When growth stocks decline, value stocks or bonds may hold their ground. By choosing investments with low or negative correlation, you can smooth out the ups and downs of your portfolio.

One of the most practical ways to achieve broad diversification is through low-cost index funds or exchange-traded funds (ETFs). These funds hold hundreds or even thousands of securities, instantly giving you exposure to a wide range of companies and sectors. Instead of trying to pick individual winners, you benefit from the overall performance of a market or region. For instance, a total stock market fund gives you ownership in nearly every publicly traded U.S. company, while an international index fund spreads your risk across global economies. These tools make diversification accessible, even for investors with limited time or expertise.

Geographic diversification is another key layer. Relying solely on one country’s economy—like the United States—exposes you to local risks, such as policy changes, economic slowdowns, or sector-specific downturns. By including international investments, you tap into growth opportunities elsewhere and reduce dependence on any single market. Similarly, sector balance matters. Even within stocks, overconcentration in areas like technology, healthcare, or energy can create vulnerability. A well-diversified portfolio includes a mix of sectors, so no single industry’s performance dominates your results.

Diversification isn’t about eliminating risk—it’s about managing it wisely. You won’t avoid losses entirely, but you can reduce their impact. Over time, this approach leads to more stable growth and fewer emotional decisions. When one part of your portfolio struggles, others may be holding steady or even rising, helping you stay on track without panic.

Risk Control: Building a Safety Net That Works

Growing your money is important, but protecting it is what ensures long-term success. I’ve come to see risk control not as a limitation, but as a form of financial discipline—one that allows me to invest with confidence. Without a plan to manage downside risk, even the most promising strategy can unravel during tough times. That’s why I’ve built several safeguards into my approach, not to avoid losses completely, but to prevent them from becoming catastrophic.

One of the most effective tools I use is regular portfolio rebalancing. Over time, some investments grow faster than others, causing your original asset allocation to shift. For example, if stocks perform well, they might grow from 60% of your portfolio to 75%, increasing your exposure to market risk. Rebalancing means selling some of the outperforming assets and buying more of the underrepresented ones to return to your target mix. This forces you to “sell high and buy low,” a principle that supports long-term growth. I schedule rebalancing once a year or after my portfolio drifts more than 5% from its target, which keeps my risk level consistent without requiring constant attention.

Another key part of my safety net is maintaining a cash reserve. This isn’t part of my investment portfolio—it’s separate, liquid savings that cover three to six months of living expenses. Having this buffer means I don’t have to sell investments during a market downturn to cover unexpected costs. Whether it’s a home repair, medical bill, or job transition, knowing I have accessible funds reduces stress and prevents impulsive financial decisions. I keep this money in a high-yield savings account, where it earns some interest while remaining safe and available.

I’ve also adopted clear exit rules for certain investments. While I don’t try to time the market, I do set guidelines for when to sell. For example, if a stock I own drops more than 15% due to fundamental problems—like declining revenue or poor management—I reassess whether it still belongs in my portfolio. This isn’t about fear; it’s about accountability. Without predefined rules, it’s easy to hold onto losing investments out of hope or emotion, which can lead to deeper losses. These controls don’t guarantee profits, but they do help me stay disciplined and avoid costly mistakes.

Practical Moves: Simple Habits That Protect and Grow

One of the biggest surprises in my investing journey has been how much small, consistent habits matter. I used to think I needed complex strategies or frequent trading to succeed. But the truth is, long-term results come from simple, repeatable actions done regularly. The most powerful tools in my financial toolkit aren’t advanced algorithms or insider knowledge—they’re basic practices that anyone can adopt, regardless of experience or income level.

Automating my contributions has been one of the most impactful changes. Instead of waiting to see how much money I have left at the end of the month, I set up automatic transfers to my investment accounts right after payday. This ensures that I pay myself first, treating savings like a non-negotiable bill. Over time, this habit has created a steady flow of new money into my portfolio, allowing me to take advantage of dollar-cost averaging—buying more shares when prices are low and fewer when they’re high. This smooths out the cost of investing and removes the pressure to time the market.

Another simple but powerful habit is scheduling regular check-ins with my financial plan. I set a calendar reminder every quarter to review my goals, track progress, and assess whether my portfolio still aligns with my needs. These reviews aren’t about making constant changes—they’re about staying aware. Life changes: you might get married, have children, change jobs, or face new expenses. These events can shift your financial priorities, and your investment strategy should reflect that. A brief review helps me catch drift early and make intentional adjustments, rather than reacting in crisis mode.

Perhaps the most valuable habit I’ve developed is learning to ignore market noise. News headlines, social media trends, and economic forecasts can create a sense of urgency, but most of it has little bearing on long-term outcomes. I’ve trained myself to focus on what I can control—my savings rate, my asset allocation, my emotional responses—rather than obsessing over things I can’t, like daily market movements. This mindset shift has reduced anxiety and improved my decision-making. By staying consistent and avoiding knee-jerk reactions, I’ve been able to stick with my plan through multiple market cycles.

When Markets Turn: Staying Calm and Sticking to the Plan

Market volatility is inevitable. No strategy can prevent it, and no investor is immune to its emotional impact. I’ve felt the knot in my stomach when the news reports a sharp drop, or when friends talk about pulling their money out “until things calm down.” In those moments, the urge to act—to sell, to hide in cash, to chase the latest safe haven—can be overwhelming. But I’ve learned that the most powerful response is often no response at all. Staying calm and sticking to a well-thought-out plan is what separates successful investors from those who sabotage their own progress.

What helps me stay grounded is having an investment policy statement—a personal document that outlines my financial goals, risk tolerance, time horizon, and strategy. It includes my target asset allocation, rebalancing rules, and guidelines for when to make changes. When emotions run high, I go back to this document. It reminds me why I made certain choices and helps me resist the temptation to deviate based on fear. It’s like a contract with my future self, ensuring that short-term feelings don’t override long-term thinking.

History shows that trying to time the market rarely works. Missing just a few of the best-performing days can drastically reduce your returns over time. For example, if you were out of the market during the ten best days in a decade, your overall growth could be cut in half. Staying invested, even during downturns, allows you to participate in the recovery. I’ve seen this firsthand: after every major drop I’ve lived through, the market eventually bounced back—and those who stayed in were rewarded.

Sticking to the plan doesn’t mean being rigid. It means having a clear framework that allows for thoughtful adjustments when necessary, rather than impulsive reactions. It means understanding that volatility is not a flaw in the system—it’s part of how markets work. By preparing for it in advance, you can face it with confidence instead of fear.

Building Lasting Wealth: The Bigger Picture

Looking back on my journey, I realize that my biggest financial victory wasn’t a year of exceptional returns. It was the quiet consistency of building a strategy that endured. True wealth, I’ve learned, isn’t measured just by account balances—it’s measured by security, freedom, and peace of mind. It’s knowing that you have a plan, that you’re prepared for uncertainty, and that you’re not at the mercy of every market swing.

Investing is not a sprint; it’s a marathon. The goal isn’t to get rich quickly, but to grow steadily while protecting what you’ve earned. This balance between growth and preservation is what makes financial progress sustainable. It allows you to weather downturns without derailing your goals, to make thoughtful decisions instead of emotional ones, and to build a legacy that lasts beyond your lifetime.

The strategies I’ve shared—asset allocation, diversification, risk control, and disciplined habits—are not secrets. They’re time-tested principles used by financial professionals and everyday investors alike. What matters is not how complex your plan is, but how well you stick to it. By focusing on what you can control, staying informed without being overwhelmed, and keeping your long-term vision clear, you can build real financial strength.

At the end of the day, smart investing isn’t about beating the market. It’s about creating a financial life that supports the life you want to live. That’s the kind of success that lasts—not just through one market cycle, but through decades of change, challenge, and growth.