How I Tamed My Credit Cards Without Losing My Mind

I used to dread checking my credit card statements—late fees, confusing charges, and that sinking feeling of being one swipe away from disaster. Sound familiar? I’ve been there, buried under balances and bad habits. But after testing real financial tools and strategies, I found a way out. It wasn’t magic—just smart, practical steps that actually work. Now, I’m sharing what transformed my credit game for good. This is not a story of sudden wealth or extreme frugality. It’s about regaining control, one thoughtful decision at a time. And if you’ve ever felt overwhelmed by plastic, interest, or your own spending patterns, this journey might just be yours too.

The Moment Everything Changed

It happened in the middle of a Tuesday afternoon, standing in line at the grocery store with a cart full of essentials—milk, bread, a bag of apples, and my daughter’s favorite cereal. I handed over my card, smiled at the cashier, and waited for the familiar beep. Instead, silence. Then, a quiet but firm, “I’m sorry, the transaction was declined.” My face flushed. I fumbled for my wallet, pulled out another card—same result. The line behind me grew longer. I apologized, pushed the cart aside, and left with only half the items. Humiliation burned through me. It wasn’t just about the groceries. It was the realization that I had lost control of something meant to make life easier.

That moment wasn’t unique. Millions of people have stood in that same line, faced that same silence. But what made it pivotal was what came next: I stopped blaming the card. I stopped blaming the bank. I looked in the mirror and admitted that the problem wasn’t the tool—it was how I was using it. Credit cards weren’t the enemy. My lack of awareness, poor tracking, and emotional spending were. For years, I treated my credit card like free money. Every purchase felt harmless in the moment. But the bill at the end of the month? That was a different story. Late fees piled up. Interest compounded. Minimum payments barely dented the balance. I was borrowing from tomorrow to pay for today, and tomorrow kept getting further away.

The turning point wasn’t dramatic. There was no financial advisor, no windfall, no emergency loan. It was a quiet decision: to stop avoiding my statements, to stop pretending everything was fine. I opened my latest bill—not just to pay it, but to read it. I looked at every charge. I totaled the interest. I calculated how long it would take to pay off the balance if I only made minimum payments. The answer? Over ten years. For purchases I no longer remembered. That number shook me. But it also clarified everything. I didn’t need a new card. I needed a new mindset. And that shift—from denial to ownership—was the first real step toward freedom.

What Financial Tools Really Are (And Why They Matter)

When most people hear “financial tools,” they think of apps, spreadsheets, or budgeting software. But tools aren’t just digital—they’re any system that brings clarity and accountability to your money. A notebook where you log expenses is a tool. A calendar with payment reminders is a tool. Even a simple rule, like “no unplanned purchases over $50,” counts. The key isn’t sophistication—it’s consistency. Tools work because they replace guesswork with data, emotion with structure. They turn abstract anxiety into concrete action.

Why do we need them? Because willpower fails. Memory fades. And emotions cloud judgment. Relying on mental tracking is like trying to carry water in your hands—it leaks out before you get anywhere. Studies show that people who track their spending are more likely to save, pay down debt, and feel in control. But tracking isn’t about punishment. It’s about awareness. When you see exactly where your money goes, patterns emerge. You notice the $4 daily coffee adds up to $120 a month. You realize the “small” online subscriptions total $80 without delivering real value. Data doesn’t lie. And once you see the truth, you can make better choices.

Take alerts, for example. Most credit card issuers offer free notifications for purchases, balance thresholds, or due dates. These aren’t just conveniences—they’re guardrails. A simple text saying “$75 spent at online retailer” can stop an impulse buy before it spirals. Payment reminders prevent late fees, which can cost $30 or more per incident and damage your credit score. One woman I spoke with set up an alert at 30% of her credit limit. When she hit that point, she paused spending until the next billing cycle. That one rule saved her over $400 in interest within six months.

Another powerful tool is the spending calendar. Instead of letting transactions blur together, map them out weekly. Group charges by category—groceries, utilities, dining, entertainment. At the end of each week, review what you spent and compare it to your goals. Did you go over on dining out? Did an unexpected expense pop up? This isn’t about perfection. It’s about progress. The goal is to create a feedback loop: spend, review, adjust, repeat. Over time, this builds financial muscle memory. You start making decisions based on insight, not impulse. And that’s when real change begins.

The Payoff of Smart Credit Card Use

Credit cards get a bad reputation, but the truth is, they aren’t inherently good or bad. Like any tool, their value depends on how you use them. When managed wisely, credit cards can be powerful allies in building financial health. The benefits are real: improved credit scores, cash back or travel rewards, purchase protection, and detailed spending records. But these perks only come with discipline. The difference between a credit card that helps and one that harms often comes down to one habit: paying the full balance every month.

Consider two real-life examples. Sarah pays her balance in full each month. She uses her card for groceries, gas, and online bills—tracking every charge in her budgeting app. Because she never carries a balance, she pays zero interest. Over the year, she earns $220 in cash back and sees her credit score rise from 680 to 740. That higher score means better rates on loans, lower insurance premiums, and more negotiating power.

Now meet James. He also uses his card daily, but only pays the minimum each month. His $3,000 balance accrues 19.99% interest. At the minimum payment, it will take him over 14 years to pay it off—and he’ll pay nearly $4,000 in interest. His credit utilization is high, dragging his score down. He’s not building credit; he’s damaging it. The same tool, two completely different outcomes.

The key is understanding credit utilization—the ratio of your balance to your credit limit. Experts recommend keeping it below 30%, ideally under 10%. High utilization signals risk to lenders, even if you make payments on time. By keeping balances low and paying in full, you demonstrate responsible use. Over time, this builds a strong credit history, which opens doors. Landlords check scores. Employers sometimes do. Even cell phone providers offer better plans to those with solid credit.

Rewards are another benefit, but only if you’re not paying more in interest than you earn. Cash back, points, and miles can add up—$500, $1,000, even more per year for heavy but disciplined users. But rewards should never be the reason to spend. They’re a bonus, not a goal. When used strategically, credit cards become a source of insight, not stress. Monthly statements show spending trends. Apps categorize expenses. This data helps you plan better, save smarter, and avoid future debt. The real payoff isn’t the free flight—it’s the confidence that comes from knowing exactly where your money goes.

Risks Lurking in the Fine Print

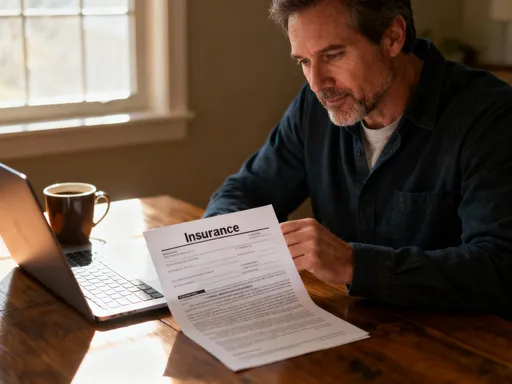

Every credit card agreement comes with fine print—and that’s where the real risks hide. Many people never read it, assuming the terms don’t matter as long as they pay on time. But small oversights can lead to big costs. The most common trap? The minimum payment. It feels manageable—$25, $50, sometimes less. But paying only the minimum extends debt for years and multiplies interest. A $2,000 balance at 17% APR takes over 13 years to pay off with minimum payments, costing more than $1,800 in interest. That’s money lost, not saved.

Another hidden cost: cash advance fees. Need quick cash? Withdrawing from an ATM using your credit card might seem convenient. But the fee is typically 3–5% of the amount, plus a higher interest rate that starts accruing immediately—no grace period. A $300 withdrawal could cost $15 in fees and 24% interest from day one. Within months, that small loan becomes much more expensive than a short-term personal loan or even a payday alternative from a credit union.

Penalty APRs are another danger. Miss one payment by even a day or two, and your interest rate could jump from 15% to 29.99%. Some issuers apply this rate to your entire balance, not just new charges. That sudden spike can make debt feel impossible to escape. One mother shared how a late payment—caused by a billing date change she didn’t notice—led to a $60 late fee and a rate hike that added over $1,000 to her repayment total. She hadn’t read the terms. She didn’t know it could happen.

Balances transfers offer relief but come with risks too. A 0% intro rate for 12 or 18 months sounds ideal, but if you don’t pay off the balance before the promotional period ends, the standard rate kicks in—often higher than your original card. Plus, most transfers charge a fee of 3–5%. A $5,000 transfer could cost $150–$250 upfront. And if you keep using your old card while paying down the transfer, you’re digging a deeper hole.

The lesson? Read the terms. Know the fees. Understand the rates. Financial literacy isn’t about memorizing jargon—it’s about asking the right questions. What’s the penalty for late payment? Is there a foreign transaction fee? How long is the grace period? When does the intro rate expire? These details matter. Ignorance isn’t bliss. It’s expensive. But awareness? That’s power. When you understand the rules, you can play the game wisely—and avoid the traps designed to catch the inattentive.

Building Your Personal Credit Management System

There’s no one-size-fits-all solution for managing credit cards. What works for a busy single parent might not suit a retired couple. The goal isn’t perfection—it’s sustainability. Your system should fit your life, not force your life to fit it. Start by choosing a tracking method that matches your habits. If you’re tech-savvy, apps like Mint, YNAB (You Need A Budget), or your bank’s built-in tools can sync transactions automatically. They categorize spending, send alerts, and show trends over time. For others, a simple notebook or spreadsheet works better. The act of writing down each purchase increases mindfulness. It makes spending feel real, not abstract.

Next, set up payment reminders. Use your phone’s calendar, a physical planner, or automatic bill pay. The goal is to never miss a due date. Even one late payment can trigger fees and hurt your score. Schedule reminders at least three days before the due date. If you’re paid weekly or biweekly, align your payments with your income. This ensures funds are available and reduces stress. One woman I spoke with sets a rule: she pays her card the same day she gets paid. “It’s like paying myself first,” she said. “I know the money is gone, so I don’t spend it twice.”

Categorizing spending is another key step. Divide charges into groups: essentials (rent, utilities, groceries), semi-essentials (gas, prescriptions), and discretionary (dining, entertainment, shopping). Review these weekly. Ask: Did I stay within my limits? Where did I overspend? Was it necessary? This isn’t about guilt. It’s about learning. Over time, you’ll spot patterns. Maybe you’re spending too much on takeout. Or subscription services have crept in unnoticed. Once you see it, you can adjust.

A sample weekly review might look like this: every Sunday evening, open your statement, check all transactions, confirm no errors, and compare spending to your budget. If you’re over in one category, decide how to compensate—cut back next week or shift funds from another area. Then, schedule your payment. This 20-minute routine builds awareness and prevents surprises. Consistency matters more than complexity. A simple, repeatable system beats a perfect one you abandon after two weeks. The best tool is the one you actually use.

When Tools Aren’t Enough—Adding Discipline

Tools provide structure, but they can’t change behavior on their own. Discipline is the missing piece. It’s what turns knowledge into action. And discipline isn’t about willpower—it’s about habits. One of the most effective is the 24-hour rule: wait one day before making any non-essential purchase over a set amount, say $50. This pause breaks the cycle of impulse spending. It gives emotions time to settle and logic time to catch up. Often, after 24 hours, the urge passes. The item that felt urgent no longer seems necessary.

Another strategy is spending intention. Before using your card, pause and ask: Why am I making this purchase? Is it a need or a want? Does it align with my goals? This mental checkpoint builds awareness. One woman started asking herself, “Will I remember this purchase in a month?” If the answer was no, she reconsidered. She saved over $300 in three months just by slowing down.

Emotional spending is a common challenge. Stress, boredom, loneliness—these can all trigger unnecessary purchases. Recognizing the trigger is the first step. The next is replacing the habit. Instead of shopping when stressed, try a walk, a phone call with a friend, or journaling. These alternatives don’t cost money—and they address the real need.

Setbacks will happen. You might overspend during the holidays or face an unexpected expense. That’s normal. The key is not perfection, but recovery. Don’t abandon your system because of one misstep. Review what happened, learn from it, and recommit. Self-compassion is part of discipline. Be kind, but accountable. Tools support good habits, but only you can choose to use them. And every small decision—every avoided impulse, every on-time payment—builds confidence. Over time, discipline becomes second nature.

Turning Control Into Long-Term Freedom

Financial control isn’t about restriction. It’s about freedom. When you manage your credit cards wisely, you’re not limiting your life—you’re expanding it. You gain the ability to make choices without fear. You can save for a family vacation, help a child with college, or build a cushion for emergencies. You’re no longer one unexpected bill away from crisis. That peace of mind is priceless.

Mastering credit card use also builds broader financial confidence. The skills you develop—tracking, budgeting, planning—apply to every area of money management. You start making informed decisions about loans, savings, and investments. You become less reactive, more proactive. And that shift changes everything. Small, consistent actions compound over time. Paying on time. Keeping balances low. Reviewing statements. These habits may seem minor, but their impact is profound.

Financial tools aren’t just for fixing problems. They’re for creating opportunities. They help you move from survival to stability, from stress to security. And the best part? You don’t need a finance degree or a high income to start. You just need awareness, a few simple tools, and the willingness to try. The journey isn’t always easy, but it’s worth it. Every step forward is a step toward a calmer, clearer, more confident financial life. And that’s a goal worth working for.