How I Stopped Wasting Money on Investments and Started Building Real Wealth

Ever feel like your money disappears into investments but never grows? I’ve been there—pouring cash into flashy opportunities, only to see little return. It wasn’t until I started analyzing costs behind every move that things changed. This is the breakdown I wish I had as a beginner: simple, honest, and focused on what actually matters—growing wealth without wasting resources. No jargon, just real insights. What I discovered wasn’t a secret formula or a hidden market trick. It was far simpler: most people lose ground not because they pick bad investments, but because they ignore the invisible costs draining their portfolios. These aren’t one-time fees or obvious mistakes. They’re the small, silent leaks—platform charges, inefficient structures, emotional decisions—that accumulate over time and quietly sabotage long-term growth. Once I learned to spot them, everything shifted. My returns didn’t skyrocket overnight, but they became more consistent, more predictable, and far less wasteful. This is the path from confusion to clarity, from spending money on investments to actually building wealth.

The Hidden Cost of Getting Started

Many new investors believe that opening a brokerage account or buying shares is a simple, low-cost entry into the world of wealth building. What they often don’t realize is that the journey begins with a series of small but persistent expenses that, over time, can significantly reduce overall returns. These are not always labeled as fees, nor do they appear in bold print on a monthly statement. Instead, they hide in the mechanics of investing—platform charges, advisory fees, custodial costs, and bid-ask spreads. Each of these may seem negligible on its own, but together, they form a steady undercurrent pulling wealth away from the investor.

Consider the common scenario of an individual opening an account with a popular online brokerage. The platform advertises low fees and easy access, which feels like a win. But upon closer inspection, the investor might find that while trade commissions are minimal or zero, other charges apply. For example, some platforms impose inactivity fees if no trades are made within a certain period. Others charge for wire transfers, account closures, or even for receiving paper statements. Then there are advisory services—robo-advisors or human financial planners—that often come with annual management fees ranging from 0.25% to over 1%. For someone with a $50,000 portfolio, even a 0.5% fee means $250 per year, deducted before any growth is realized.

Beyond direct fees, there are structural costs embedded in the investments themselves. Mutual funds, for instance, carry expense ratios that cover management, administration, and marketing. These are deducted automatically from fund assets, reducing the net return passed on to investors. An actively managed fund with a 1.2% expense ratio may perform well on paper, but after fees, its real return could lag behind a low-cost index fund with a 0.05% ratio—even if both track similar markets. The difference may seem small in a single year, but compounded over decades, it can amount to tens of thousands of dollars in lost growth.

Equally important is the bid-ask spread—the difference between the price at which you can buy a security and the price at which you can sell it. This gap is especially wide in less liquid markets or with niche exchange-traded funds. When an investor buys and sells frequently, these spreads accumulate, acting as a hidden transaction cost. Over time, this friction erodes returns without ever appearing as a line item on a bill. The emotional cost is also real. Many beginners spend hours researching, second-guessing decisions, and reacting to market swings—time and energy that could be better spent elsewhere. Recognizing these hidden costs is not about fear or avoidance. It’s about awareness. When you understand where money truly goes, you can make intentional choices that protect your capital and set the foundation for sustainable wealth.

Why Free Isn’t Always Free

The rise of commission-free trading platforms has transformed how people approach investing. Names like Robinhood, Webull, and others have popularized the idea that buying stocks and ETFs can be completely free. On the surface, this seems like a major win for everyday investors—especially those just starting out with limited funds. No trade fees mean more money stays in the portfolio, right? While that’s partially true, the reality is more nuanced. The term “free” in finance often comes with trade-offs that aren’t immediately obvious. Understanding what you’re giving up in exchange for zero commissions is essential to making informed decisions.

One of the most common trade-offs is the quality and depth of research tools. Full-service brokerages like Fidelity or Charles Schwab may charge small fees for certain services, but they also offer extensive educational resources, in-depth market analysis, portfolio modeling tools, and access to financial advisors. In contrast, many commission-free platforms provide minimal research support. Their interfaces are streamlined for quick trades, not thoughtful planning. For a beginner investor trying to learn the basics of asset allocation or evaluate a company’s fundamentals, this lack of guidance can lead to poor decisions—costing far more in the long run than any avoided fee.

Another hidden cost lies in execution quality. Some zero-commission platforms route customer orders to third-party market makers, who profit from the bid-ask spread. While this practice is legal and disclosed, it means investors may not always get the best available price when buying or selling. In fast-moving markets, this can result in slippage—buying slightly higher or selling slightly lower than expected. Over time, these small inefficiencies add up, especially for frequent traders. Additionally, some platforms limit access to certain investment types. For example, they may not support international stocks, municipal bonds, or options trading. This restricts diversification and forces investors to use multiple accounts, increasing complexity and the risk of oversight.

There’s also the issue of product selection. Some platforms promote proprietary funds or structured products with embedded fees that aren’t immediately visible. A fund might appear to have no transaction cost, but its internal expenses could be significantly higher than industry averages. Similarly, fractional share investing—while helpful for building positions gradually—can lead to over-concentration in a few high-profile stocks, increasing risk. The convenience of buying a slice of Apple or Tesla with $5 may feel empowering, but without a broader strategy, it can result in an unbalanced portfolio. The lesson here is not to reject free platforms outright, but to look beyond the headline claim. True cost analysis means asking: What am I sacrificing for this convenience? Is the trade-off worth it for my goals? By shifting the question from “Is this free?” to “What’s the real cost?”, investors gain a more complete picture and avoid paying in ways they didn’t anticipate.

Asset Allocation: More Than Just Spreading Risk

When most people think about asset allocation, they focus on risk reduction—spreading money across different types of investments to avoid losing everything if one sector crashes. That’s a valid goal, but it’s only part of the story. A more complete view includes cost efficiency. Different asset classes and investment vehicles come with varying levels of ongoing expenses, and those costs directly impact net returns. A well-diversified portfolio can still underperform if it’s built on high-cost components. The key is to balance risk management with expense control, ensuring that the structure of your investments supports long-term growth rather than undermining it.

Take mutual funds, for example. They offer instant diversification and professional management, which can be appealing to new investors. However, many mutual funds—especially actively managed ones—carry high expense ratios. These fees cover the cost of research teams, portfolio managers, and marketing efforts. While some active funds outperform the market in certain years, studies consistently show that over long periods, the majority fail to beat low-cost index funds after fees are accounted for. The reason is simple: higher costs eat into returns. Even a 1% annual fee may not seem like much, but over 20 or 30 years, it can reduce the final portfolio value by a significant margin. The compounding effect works both ways—on gains and on costs.

Exchange-traded funds (ETFs) have become a popular alternative because they often offer similar diversification at a fraction of the cost. Many broad-market ETFs track major indices like the S&P 500 and charge expense ratios as low as 0.03% per year. That means for every $10,000 invested, the annual cost is just $3. Compare that to a mutual fund charging 1%, and the difference becomes clear. Over time, the lower-cost ETF will deliver more of the market’s return to the investor. This doesn’t mean all ETFs are low-cost—some niche or leveraged ETFs carry higher fees and risks—but the trend toward low-cost indexing has empowered investors to capture market returns efficiently.

Beyond stocks and bonds, alternative assets like real estate investment trusts (REITs), commodities, or private equity funds can play a role in diversification. However, these often come with higher fees, less liquidity, and more complex tax implications. For the average investor, especially one focused on steady wealth building, the benefits may not outweigh the added costs. The goal is not to eliminate all expenses—some level of cost is inevitable in any financial system—but to ensure that every dollar spent delivers clear value. A low-cost, broadly diversified portfolio of index funds and ETFs, rebalanced periodically, has proven to be one of the most effective strategies for long-term wealth accumulation. It’s not flashy, but it’s reliable. By prioritizing cost efficiency in asset allocation, investors protect their returns and create a stronger foundation for growth.

The Time Cost Most People Ignore

When people think about investing, they usually focus on money—how much to invest, where to put it, and what returns to expect. Rarely do they consider time as a resource worth measuring. Yet for many, especially those balancing careers, family, and personal interests, time is just as valuable as capital. The hours spent researching stocks, monitoring daily price movements, adjusting allocations, or reacting to market news are hours that could be spent with loved ones, on hobbies, or improving skills. This is the concept of opportunity cost: what you give up by choosing one activity over another. In personal finance, time is a hidden but real expense that can erode the quality of life even if the portfolio grows.

Consider the investor who checks their portfolio multiple times a day, reads financial news obsessively, and tweaks their holdings based on short-term trends. This behavior may feel productive, but it often leads to overtrading—a well-documented phenomenon where frequent buying and selling increases transaction costs and reduces returns. More importantly, it creates mental fatigue. Markets are inherently volatile, and reacting to every fluctuation can lead to emotional decision-making. Selling during a downturn out of fear, or buying into a rally out of excitement, are common mistakes that hurt long-term results. The time spent in this cycle isn’t just unproductive—it’s counterproductive.

A better approach is to design an investing strategy that minimizes time drain while maximizing effectiveness. Automated investing is one of the most powerful tools available. By setting up recurring contributions to a diversified portfolio, investors can benefit from dollar-cost averaging—buying more shares when prices are low and fewer when prices are high—without having to think about it. Many platforms allow users to schedule monthly transfers from a bank account directly into ETFs or mutual funds. Once the plan is in place, it runs in the background, freeing up mental space and time.

Regular but infrequent check-ins—such as quarterly or semi-annual reviews—are usually sufficient to assess performance, rebalance if needed, and make adjustments based on life changes. This disciplined rhythm prevents overreaction while ensuring the portfolio stays aligned with long-term goals. For those who enjoy learning, dedicating a few hours a month to financial education can be more rewarding than daily market watching. Reading books, listening to reputable podcasts, or taking online courses builds lasting knowledge without the stress of constant monitoring. The goal is not to disengage, but to invest smarter—not harder. When time is treated as a valuable resource, investors make choices that support both financial and personal well-being.

When Simplicity Beats Sophistication

The financial industry often markets complexity as sophistication. Products with intricate structures, exotic names, or promises of high returns attract attention because they seem advanced, exclusive, or innovative. But in reality, these complex investments frequently come with higher fees, less transparency, and greater risk. For the average investor, especially one focused on steady wealth building, simplicity is not a compromise—it’s a strategic advantage. A straightforward portfolio of low-cost index funds, held consistently over time, has historically outperformed most complex strategies after accounting for fees and taxes.

Structured products, for example, are financial instruments designed to offer customized payoffs, often combining bonds with derivatives. They may promise principal protection or enhanced returns under certain market conditions. However, they are typically sold with high commissions, opaque pricing, and long lock-up periods. Investors may not fully understand how the product works or what risks they’re taking. When the market behaves in unexpected ways, the promised benefits can vanish, leaving the investor with losses and limited options to exit. Similarly, leveraged ETFs, which aim to deliver multiples of daily index returns, sound appealing in rising markets. But due to the effects of compounding, their long-term performance often diverges significantly from the underlying index, making them unsuitable for buy-and-hold investors.

Even seemingly simple choices can become complicated when layered with unnecessary features. Target-date funds, for instance, are designed to automatically adjust asset allocation as retirement approaches. They are a good option for hands-off investors, but not all are created equal. Some have high expense ratios or include proprietary funds that benefit the provider more than the investor. A careful review of the fee structure and underlying holdings is essential. The same applies to managed accounts or personalized portfolios offered by financial advisors. While professional guidance can be valuable, it’s important to ensure that the services provided justify the cost. Sometimes, a simple DIY approach using low-cost ETFs delivers similar or better results at a fraction of the price.

Simplicity also supports peace of mind. A portfolio that’s easy to understand is easier to stick with during market downturns. When investors know exactly what they own and why, they’re less likely to panic and sell at the worst time. Clarity reduces anxiety, which in turn leads to better decision-making. The goal of investing isn’t to impress others with complexity, but to build wealth reliably over time. By choosing straightforward, low-cost, and transparent investments, individuals protect their returns, reduce stress, and create a sustainable path to financial security.

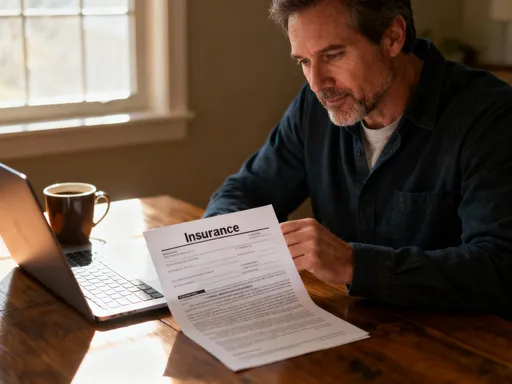

Tracking What Really Matters

Most investors focus heavily on returns—how much their portfolio has grown over the past month, quarter, or year. While performance is important, it’s only one piece of the puzzle. A more meaningful metric is the cost-to-growth ratio: how much you’re spending to earn what you’re earning. Two portfolios can have the same return, but if one achieves it with lower fees and less time investment, it’s objectively more efficient. Shifting focus from raw returns to net efficiency changes how you evaluate success. It encourages discipline, transparency, and long-term thinking.

To track this, start by calculating your total investment costs annually. This includes platform fees, advisory charges, fund expense ratios, and any transaction costs. Many brokerages provide a consolidated view of fees in annual reports or tax documents. Once you have that number, compare it to your portfolio’s growth. For example, if your portfolio grew by 7% but you paid 1% in fees, your net return is 6%. That 1% matters—it’s money that didn’t compound over time. Over decades, that difference can amount to a substantial portion of your wealth. More importantly, ask whether the services you’re paying for are truly adding value. Did the advisor adjust your strategy in a way that improved outcomes? Or could you have achieved similar results with a lower-cost approach?

Another useful practice is to assess portfolio efficiency. Are your assets working as hard as they could? Are there redundant holdings or underperforming funds that could be replaced with lower-cost alternatives? Periodic reviews—once or twice a year—are enough to identify inefficiencies without falling into the trap of over-management. Rebalancing, when necessary, helps maintain your target allocation and prevents risk drift. But it should be done thoughtfully, not automatically, to avoid unnecessary trading costs.

The goal is not to eliminate all costs—some are necessary for access, security, and guidance—but to ensure they are justified. Every dollar spent should have a clear purpose and deliver measurable benefit. When you track cost efficiency, you shift from being reactive to being intentional. You stop chasing performance and start building a system that works reliably over time. This mindset leads to better decisions, greater confidence, and ultimately, more sustainable wealth growth.

Building a Low-Cost, High-Impact Strategy

Creating lasting wealth doesn’t require picking winning stocks, timing the market, or using complex financial products. What it does require is consistency, discipline, and a clear understanding of costs. The most effective investment strategies are often the simplest: invest regularly in low-cost, diversified funds, minimize fees, automate contributions, and avoid emotional decisions. These principles may not generate headlines, but they have helped millions build financial security over time. The key is not to seek perfection, but to make steady progress by eliminating avoidable waste.

Start by choosing the right tools. Select a brokerage that aligns with your needs—low fees, reliable service, and access to the investments you want. If you prefer hands-off management, a low-cost robo-advisor might be suitable. If you enjoy more control, a self-directed account with access to index ETFs could be better. Whichever path you choose, prioritize transparency and cost efficiency. Read the fine print, understand the fee structure, and avoid products that promise more than they deliver.

Next, build a diversified portfolio using low-cost index funds or ETFs that cover broad markets. A simple three-fund portfolio—U.S. stocks, international stocks, and bonds—can provide excellent diversification with minimal effort and expense. Rebalance occasionally to maintain your target allocation, but avoid frequent changes based on market noise. Let compounding work in your favor by staying invested through market cycles.

Automate as much as possible. Set up recurring transfers so that investing happens automatically, reducing the temptation to delay or skip contributions. Use tax-advantaged accounts like IRAs or 401(k)s when available, as they enhance long-term growth through tax deferral or exemption. Stay informed, but don’t overconsume financial news. Focus on reliable sources and long-term trends rather than daily fluctuations.

Finally, review your progress regularly—not to obsess over short-term results, but to ensure your strategy remains aligned with your goals. Life changes—marriage, children, career shifts—and your financial plan should adapt accordingly. But the core principles remain the same: minimize costs, maximize efficiency, and stay consistent. Wealth isn’t built in a single moment. It’s the result of small, smart choices repeated over time. By focusing on what truly matters, you stop wasting money on investments and start building real, lasting wealth.