How I Turned Gift Giving Into a Smarter Investment Move

What if the gifts you give could also grow your wealth? I never thought about it until tax season hit and I saw how much I’d unknowingly lost. That’s when I started digging into gift tax rules—not just to stay legal, but to build a smarter investment strategy. What I found changed how I plan my finances. It’s not about avoiding taxes; it’s about using the system to your advantage. Let me walk you through how this overlooked piece of financial planning can actually fuel long-term growth. The idea isn’t flashy or complicated, but it’s powerful: every gift can be more than an act of generosity. When done with intention, it becomes a tool for wealth transfer, tax efficiency, and intergenerational financial health. This isn’t about gaming the system—it’s about understanding it well enough to make thoughtful choices that benefit both giver and receiver for years to come.

The Moment I Realized Gift Tax Was More Than a Legal Checkbox

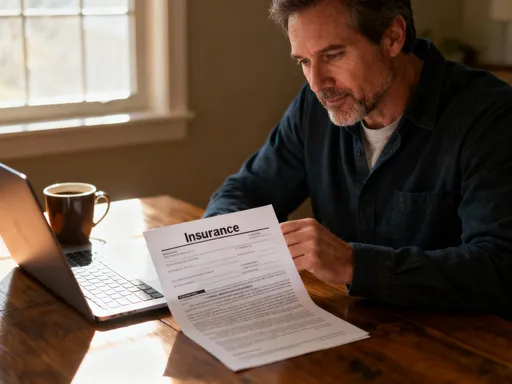

It started with a letter—one of those plain envelopes that arrive in the mailbox and immediately tighten your chest. The IRS had flagged a gift I made the previous year: a lump sum transferred to my eldest daughter to help her buy her first home. I thought I was doing something kind, something responsible. Instead, I found myself staring at forms I didn’t understand, wondering if I’d broken a rule. I hadn’t realized that gifts above a certain threshold required reporting, even if no tax was due. That moment of confusion turned into a turning point. I decided to stop reacting and start learning.

What I discovered was surprising. The gift tax system isn’t designed to punish generosity. In fact, it includes built-in allowances that most people never fully use. There’s an annual exclusion that lets individuals give a certain amount to as many people as they’d like without triggering any reporting. Then there’s a lifetime exemption—an aggregate limit on tax-free giving over a person’s life. Once I understood these two pillars, my perspective shifted. This wasn’t just about compliance. It was about structure. The tax code, it turned out, offers a framework for moving wealth early and efficiently, before it grows too large and becomes harder to manage. Instead of seeing the gift tax as a hurdle, I began to see it as a guide.

That shift in mindset changed everything. I stopped viewing large gifts as one-off acts of kindness and started seeing them as strategic financial moves. The same way I plan contributions to my retirement accounts or rebalance my portfolio, I began to treat gifting as part of my financial routine. I realized that by using the annual exclusion every year—even with modest amounts—I could transfer significant value over time, all within legal limits. And by tracking my lifetime exemption carefully, I could plan larger transfers when they made the most sense, such as when a child was starting a business or buying property. This wasn’t about hiding money or dodging taxes. It was about clarity, timing, and foresight.

Why Most People Miss the Investment Potential in Gifting

Most people think of gift giving as purely emotional—a birthday check, a holiday bonus, help with college tuition. And while those gestures come from the heart, they often overlook the long-term financial implications. The truth is, when you give an asset, you’re not just transferring money. You’re transferring future growth, tax liabilities, and ownership rights. If done without strategy, that gift might relieve short-term pressure but create bigger problems down the road. But when approached with planning, gifting becomes a powerful way to shift wealth before it expands, allowing appreciation to happen in the hands of someone with a longer time horizon.

Consider this scenario: a parent holds stock that has grown significantly over decades. If they wait until death to pass it on, the estate may face higher taxes, and the heirs inherit the asset at its current market value. But if the parent gifts that stock earlier—while still alive—the appreciation from that point forward happens in the child’s portfolio, not the parent’s. That growth is then subject to the child’s tax situation, which may be more favorable. More importantly, the asset is no longer counted toward the parent’s taxable estate. This means less exposure to estate taxes later, even if the value continues to rise.

The power lies in compounding over time. A $20,000 gift in a high-growth investment could be worth $100,000 or more in 20 years. If that growth happens outside the donor’s estate, it reduces future tax exposure and accelerates wealth building for the next generation. Yet most families never consider this. They see gifting as a withdrawal from their own resources, not as a reallocation of assets with long-term benefits. The emotional weight of “giving away” money often overshadows the financial wisdom of transferring it early. But when you reframe gifting as a structured part of financial planning—not just a spontaneous act of generosity—you unlock a tool that serves both love and logic.

Building a System: Aligning Gifting with Investment Goals

Once I understood the potential, I wanted to make it consistent. I didn’t want to rely on memory or holiday impulses. So I built a system—simple, repeatable, and integrated into my overall financial plan. Every January, I review my portfolio, my family’s needs, and the current gift tax rules. I identify which assets are best suited for transfer and which family members would benefit most. Then I schedule the gifts like any other financial transaction: documented, timed, and aligned with broader goals.

This approach transformed gifting from an occasional gesture into a disciplined practice. For example, if I’m rebalancing my portfolio and selling appreciated stock, I consider whether it makes more sense to gift some of those shares instead. By doing so, I avoid realizing the gain myself, and the recipient gets the asset at my original cost basis. If they hold it long-term, they’ll only pay capital gains when they eventually sell—and possibly at a lower rate, depending on their income. This kind of coordination turns a routine investment move into a strategic wealth transfer.

I also use gifting to fund custodial accounts for my grandchildren. Each year, I apply the annual exclusion to contribute to UGMA or UTMA accounts, investing in low-cost index funds. These accounts grow tax-efficiently, and the funds can be used for education or other qualified expenses. But more importantly, they begin building financial resilience early. The children aren’t just receiving money—they’re learning about ownership, responsibility, and long-term growth. Over decades, these small, consistent transfers compound into meaningful wealth, all while staying under the radar of gift tax reporting.

The key is intentionality. When gifting is treated as a scheduled, planned action, it becomes predictable and sustainable. It’s no longer about reacting to a need or a crisis. It’s about proactively shaping the financial future of the people you care about. And because it’s integrated with investment decisions—like rebalancing, tax-loss harvesting, or retirement planning—it strengthens the entire financial structure, not just one isolated piece.

Choosing the Right Assets to Gift—And When It Matters

Not all gifts are created equal. Giving cash is simple, but it may not be the most efficient choice. The real power comes from transferring assets that have strong growth potential but aren’t yet at their peak value. For instance, low-basis stocks—those purchased long ago at a low price—can be excellent candidates for gifting. When you give them, the recipient inherits your cost basis, so if they sell immediately, they could face a capital gains tax. But if they hold onto the stock, future appreciation happens in their hands, and they may pay a lower tax rate when they eventually sell.

Real estate is another area where timing and selection matter. Imagine owning a rental property that has appreciated significantly but produces modest income. Gifting it to a child in a lower tax bracket could shift both ownership and future rental income to a more favorable tax environment. Plus, if the child lives in it or improves it, they might qualify for certain tax benefits down the road. However, this requires careful planning. Transferring real estate triggers a review of title, insurance, and possibly mortgage obligations. It’s not a decision to make lightly, but when aligned with long-term goals, it can be highly effective.

The concept of “gift timing” is just as important as the asset itself. Suppose you own shares in a company that’s about to announce a major product breakthrough. If you gift those shares before the news breaks, the future surge in value belongs to the recipient. That growth won’t count toward your estate, and the recipient benefits from the upside. This isn’t speculation—it’s smart asset management. By paying attention to market cycles, company developments, and personal milestones, you can time gifts to maximize their impact.

Conversely, gifting assets that are likely to depreciate or generate immediate tax liabilities can backfire. For example, giving a traditional IRA during life is generally not advisable, as it forces the recipient to pay income tax on withdrawals. Instead, such accounts are often better left for inheritance, where different tax rules may apply. The goal is to transfer assets that will grow, not ones that will burden. By evaluating each asset’s tax profile, growth potential, and ownership implications, you can make choices that benefit everyone involved.

Avoiding the Traps: Common Mistakes That Cost Thousands

Even well-intentioned givers can make costly errors. One of the most common is failing to document gifts properly. The IRS doesn’t require reporting for gifts under the annual exclusion, but that doesn’t mean you should skip records. Keeping a simple log—date, amount, recipient, asset type—can prevent confusion later, especially during estate audits. If a gift exceeds the annual limit, Form 709 must be filed, even if no tax is owed. Skipping this step can lead to penalties and lost exemption tracking, undermining years of careful planning.

Another frequent mistake is misunderstanding ownership rules. When you gift an asset, you give up control. Once stock is transferred to a child’s brokerage account, you can’t tell them when to sell it or how to use the proceeds. Some parents gift assets but expect to manage them, creating tension and legal complications. It’s essential to treat the transfer as final. If you’re not ready to let go, consider other strategies, like setting up a trust with specific guidelines.

Spousal gift splitting is another area where people stumble. Married couples can combine their annual exclusions to give double the amount to a single recipient without using any of their lifetime exemption. But to do this, both spouses must consent, and the gift must be properly documented. Without formal agreement, the IRS may only recognize one spouse’s contribution, leading to unnecessary reporting or tax exposure. This is especially important for larger gifts, like funding a grandchild’s education or helping a child buy a home.

Finally, many overlook the cost basis implications. Gifting an asset with a very low cost basis can create a large capital gains tax for the recipient if they sell it soon. While this might be acceptable in some cases, it’s important to discuss the tax consequences upfront. Transparency helps the recipient make informed decisions and avoids unpleasant surprises. The goal is to empower, not burden, the next generation.

How This Strategy Fits Into the Bigger Financial Picture

Gifting doesn’t exist in a vacuum. It works best when woven into a broader financial plan that includes retirement savings, tax efficiency, and legacy goals. For example, if you’re doing Roth conversions—moving money from a traditional IRA to a Roth IRA—you might time your gifting strategy to offset the higher income those conversions create. By reducing your taxable estate through gifting, you also lower the potential tax burden on your heirs, making Roth assets even more valuable in the long run.

Trusts are another natural partner to strategic gifting. While not every family needs a trust, they can provide structure for larger transfers, especially when minors or special needs beneficiaries are involved. Annual gifts can fund irrevocable trusts, which remove assets from your estate permanently while still providing for loved ones. This combination of gifting and trust planning offers both flexibility and protection, ensuring that wealth is used according to your wishes.

Asset protection is also enhanced through early gifting. By transferring ownership of certain assets well before any potential liability arises—such as health care costs or legal claims—you reduce exposure to future risks. This isn’t about hiding assets; it’s about prudent planning. Once an asset is legally owned by someone else, it’s no longer part of your personal financial picture, which can be crucial in long-term care planning or business ownership scenarios.

The synergy between these strategies is what makes them powerful. Gifting isn’t a replacement for retirement planning or insurance—it’s a complement. When done consistently and thoughtfully, it reduces future tax pressure, accelerates wealth growth for younger generations, and creates a more resilient financial ecosystem for the entire family. It’s not about giving everything away. It’s about giving wisely, at the right time, with the right assets, so that generosity and financial health go hand in hand.

Making It Work for You: A Realistic Path Forward

You don’t need to be wealthy to benefit from strategic gifting. The principles apply at every income level. Start small. Use the annual exclusion to give $15,000 or $16,000—whatever the current limit is—to each family member who could benefit. Put it on your calendar. Treat it like a bill you pay once a year. Over time, even modest amounts grow significantly, especially when invested wisely.

Next, talk to a financial advisor or tax professional. This isn’t about finding loopholes. It’s about making sure you understand the rules and stay compliant. A qualified advisor can help you track your lifetime exemption, recommend appropriate assets for transfer, and coordinate gifting with other financial moves. They can also help you navigate complex situations, like gifting to multiple children or handling business interests.

Be patient. This is a long-term strategy. The benefits may not be visible in the first year or even the first decade. But compound growth, tax efficiency, and estate reduction work quietly over time. One day, you’ll look back and realize you’ve transferred substantial value, reduced future tax burdens, and helped your family build financial confidence—all through consistent, thoughtful action.

Finally, remember that this isn’t about perfection. It’s about progress. You don’t have to gift every year, and you don’t have to transfer large sums. What matters is starting, staying informed, and aligning your generosity with your financial goals. When done right, giving isn’t just a kindness. It’s one of the smartest investments you can make.