How I Turned Summer Camp Costs into a Smarter Savings Game

By Laura Wilson / Jan 19, 2026

How I Nailed My Mortgage Game Without Losing Sleep

By Sarah Davis / Jan 19, 2026

How I Protected My Investments When Sudden Illness Hit — A Real Strategy

By Michael Brown / Jan 19, 2026

How I Stopped Wasting Money on Investments and Started Building Real Wealth

By Natalie Campbell / Jan 19, 2026

How I Mastered Wealth Transfer: An Expert’s Real Talk on Smarter Inheritance Planning

By Jessica Lee / Jan 19, 2026

Winter Camp Spending Traps: How to Protect Your Wallet Without Saying No

By Megan Clark / Jan 19, 2026

How I Keep My Money Safe Without Killing Returns

By Samuel Cooper / Jan 19, 2026

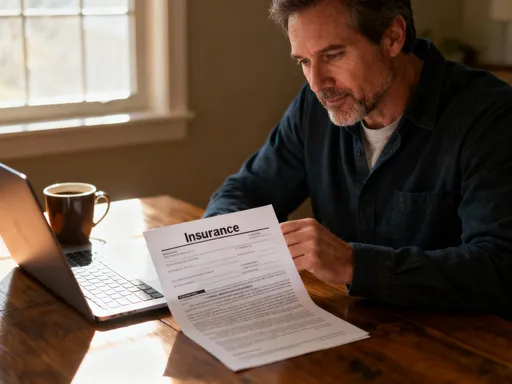

How I Protect My Money Without Losing Sleep — A Real Cost-Smart Strategy

By William Miller / Jan 19, 2026

How I Forecast Markets to Grow My Wealth—Strategy That Actually Works

By William Miller / Jan 19, 2026

Why Family Trusts Are the Quiet Power Move in Wealth Management

By John Smith / Jan 19, 2026

How I Stayed Calm When Disaster Hit—And Protected My Money

By Sophia Lewis / Jan 22, 2026

What No One Tells You About Money When the Kids Leave Home

By Daniel Scott / Jan 19, 2026

How I Turned Gift Giving Into a Smarter Investment Move

By George Bailey / Jan 19, 2026

How I Tamed My Credit Cards Without Losing My Mind

By Thomas Roberts / Jan 22, 2026

How I Turned My Gym Habits Into Smarter Money Moves

By Amanda Phillips / Jan 19, 2026

How I Keep My Money Safe When Markets Go Wild

By Joshua Howard / Jan 19, 2026

How I Keep My Money Safe While Growing It — Real Talk on Smarter Investing

By William Miller / Jan 19, 2026

How I Prepared My Money for a New Country – A Beginner’s Journey to Smarter Assets

By Emma Thompson / Jan 19, 2026

How I Protect My Portfolio Without Losing Sleep

By Christopher Harris / Jan 19, 2026

How I Launched My Side Hustle Without Betting the Farm

By Sophia Lewis / Jan 22, 2026