Why Family Trusts Are the Quiet Power Move in Wealth Management

What if the real secret to lasting wealth isn’t just making money—but protecting it the right way? I used to think estate planning was just about wills and lawyers. Then I dug deeper. What I found changed everything: family trusts aren’t just for billionaires. They’re a smart, structured way to manage assets, reduce conflict, and keep wealth in the family. This is what no one told me—but should have. For many, the idea of estate planning begins and ends with a will. Yet wills alone often fail to address the deeper risks that come with transferring wealth. Probate delays, family disagreements, tax inefficiencies, and unprepared heirs can all erode an estate long before it reaches the next generation. A family trust offers a more thoughtful alternative—one that combines legal structure with long-term vision. It’s not about hiding money or avoiding responsibility. It’s about ensuring that the wealth you’ve worked hard to build actually serves your family as intended, now and decades into the future.

The Hidden Problem with Inheritance

Inheritance is often seen as a gift—a final act of generosity from one generation to the next. But without careful planning, it can become a source of stress, conflict, and even financial loss. Many families operate under the assumption that simply listing beneficiaries in a will is enough to pass on their wealth. The reality, however, is far more complicated. When assets go through probate, the legal process can take months or even years to resolve. During that time, funds may be frozen, bills go unpaid, and family members may struggle with unexpected financial strain. This delay not only disrupts financial stability but also opens the door to disputes among heirs, especially when intentions are unclear or perceived as unfair.

Family conflict is one of the most common—and damaging—consequences of poorly structured inheritance. Siblings may argue over who receives what, particularly if one has contributed more to caregiving or if assets are distributed unevenly. In some cases, resentment builds over time, leading to broken relationships that can last for generations. Emotional tensions are often heightened when a surviving spouse is involved, or when stepchildren or blended families are part of the equation. Without a neutral mechanism to guide distributions, even well-meaning intentions can lead to confusion and hurt feelings. The absence of clear instructions can result in decisions being made in court rather than within the family, adding legal costs and public exposure to private matters.

Beyond emotional strain, unmanaged wealth is vulnerable to erosion from taxes, creditors, and poor financial decisions by beneficiaries. A lump-sum inheritance, especially to a young adult with limited financial experience, can be spent quickly on short-term desires rather than long-term security. Studies have shown that a significant percentage of inherited money is lost within a decade due to impulsive spending, bad investments, or lack of guidance. Additionally, estate taxes can take a substantial portion of an estate—sometimes as high as 40%—if no planning has been done to mitigate the burden. Without protective structures in place, wealth that took a lifetime to accumulate can vanish in just a few years, leaving future generations with little to show for it.

These challenges reveal a critical gap in traditional estate planning: a will tells the world who gets what, but it doesn’t explain how or when. It offers no protection against external threats and little guidance for responsible use. For families who want to preserve their legacy, this passive approach is no longer sufficient. The solution lies not in avoiding inheritance, but in reshaping how it’s delivered. This is where the family trust steps in—not as a replacement for a will, but as a more powerful tool for managing the transfer of wealth with greater control, privacy, and purpose.

What Is a Family Trust—and Why It’s Different

A family trust is a legal arrangement that allows a person—known as the grantor—to transfer ownership of assets to a trust, which is then managed by a trustee for the benefit of designated beneficiaries. Unlike a will, which only takes effect after death, a trust can operate during the grantor’s lifetime, offering immediate control and flexibility. The key distinction lies in how assets are held and distributed. When assets are placed in a properly funded trust, they are no longer part of the individual’s personal estate. This means they can bypass probate entirely, avoiding delays, legal fees, and public scrutiny. Instead, the trustee follows the instructions laid out in the trust document to manage and distribute assets according to the grantor’s wishes.

There are two primary types of family trusts: revocable and irrevocable. A revocable living trust is the most common for families seeking flexibility. As the name suggests, the grantor retains the ability to modify or cancel the trust at any time during their life. This allows for adjustments as circumstances change—such as the birth of a child, a change in financial status, or a shift in family dynamics. Because the grantor maintains control, a revocable trust does not provide immediate tax benefits or protection from creditors. However, it serves as a powerful estate planning tool by ensuring a smooth transition of assets and avoiding the pitfalls of probate.

In contrast, an irrevocable trust offers stronger asset protection and potential tax advantages. Once established, the terms cannot be changed without the consent of the beneficiaries, and the assets are no longer considered part of the grantor’s estate. This means they are generally shielded from creditors, lawsuits, and estate taxes. While this structure requires giving up control, it provides long-term security for beneficiaries and can be especially useful for individuals with significant assets or those in high-risk professions. Both types of trusts serve distinct purposes, and the choice between them depends on individual goals, family needs, and financial circumstances.

What makes a family trust truly different is that it functions as a rulebook for wealth, not just a container. It allows the grantor to specify not only who receives what, but also under what conditions. For example, a trust can stipulate that a child receives funds for college, homeownership, or starting a business—rather than a lump sum at a specific age. It can include provisions for health emergencies, support for a disabled family member, or even incentives for completing certain milestones. This level of customization transforms wealth transfer from a one-time event into an ongoing process of stewardship. By embedding values and intentions into the structure of the trust, families can ensure that their legacy is not just financial, but also deeply personal and purposeful.

How Trusts Protect Wealth Across Generations

The true strength of a family trust lies in its ability to preserve wealth over time. While many financial tools focus on growth, trusts are uniquely designed to protect and guide. One of the most valuable features is asset protection. When structured properly, trust assets are shielded from external threats such as creditors, divorce settlements, and legal judgments. This is particularly important for beneficiaries who may face financial challenges or high-risk professions. For example, if a child becomes involved in a lawsuit or goes through a divorce, assets held in a properly drafted trust are generally not considered part of their personal estate and therefore remain protected. This safeguard ensures that wealth stays within the family, rather than being lost to unforeseen circumstances.

Equally important is the ability to control how and when beneficiaries receive their inheritance. A common concern among parents is what might happen if a young adult gains access to a large sum of money all at once. Without financial maturity, even a well-intentioned gift can lead to poor decisions. A trust allows the grantor to stagger distributions based on age, achievement, or need. For instance, a child might receive one-third of their inheritance at age 30, another third at 35, and the remainder at 40. Alternatively, distributions can be tied to specific goals—such as completing a degree, maintaining steady employment, or purchasing a home. These mechanisms encourage responsibility and help beneficiaries develop a healthy relationship with money.

Trusts also provide critical support for family members with special needs. A special needs trust can be established to provide for a disabled child without disqualifying them from government benefits such as Medicaid or Supplemental Security Income (SSI). Since direct inheritances can interfere with eligibility for means-tested programs, this type of trust ensures that funds are used for supplemental expenses—like therapy, travel, or recreational activities—while preserving access to essential services. The trustee manages the funds with care, making distributions that enhance quality of life without jeopardizing financial aid.

Another powerful feature is the role of the trustee as a steward of values. Rather than simply handing over money, a trust allows families to embed their principles into the distribution process. For example, a trust might include incentive clauses that reward entrepreneurship, charitable giving, or continued education. These provisions transform wealth from a passive gift into an active force for personal growth. At the same time, the trustee has the discretion to respond to unexpected situations—such as a medical emergency or job loss—ensuring that support is available when needed most. This balance of structure and flexibility helps prevent dependency while promoting long-term resilience. By guiding behavior and protecting assets, family trusts become more than legal documents—they become vehicles for lasting family legacy.

Tax Efficiency Without the Hype

Taxes are one of the most significant threats to intergenerational wealth, and family trusts offer legitimate strategies to reduce the burden—without overpromising or encouraging aggressive tax avoidance. It’s important to note that not all trusts provide tax benefits, and the advantages depend heavily on the type of trust and how it’s structured. A revocable living trust, for example, does not reduce income or estate taxes during the grantor’s lifetime because the assets are still considered part of their estate. However, it can streamline the transfer of assets and help avoid probate-related costs, which indirectly preserves more wealth for heirs.

Irrevocable trusts, on the other hand, can play a more direct role in tax planning. Because the assets are no longer owned by the grantor, they are generally excluded from the estate for tax purposes. This can be especially valuable for individuals whose net worth exceeds the federal estate tax exemption, which is adjusted annually for inflation. As of recent years, the exemption has been over $12 million per individual, meaning estates below that threshold are not subject to federal estate tax. However, for larger estates, an irrevocable trust can help reduce the taxable estate and potentially save millions in taxes. It’s important to emphasize that these strategies must be implemented well in advance and in full compliance with tax laws to be effective.

Another tax-related benefit involves the stepped-up basis rule. When assets are inherited directly, their cost basis is typically “stepped up” to the market value at the time of death, which can reduce capital gains taxes when the assets are later sold. This rule generally applies whether assets pass through a will or a trust. However, trusts can enhance this benefit by allowing for more strategic timing of asset distributions or by holding appreciating assets in a tax-efficient manner. For example, a trust might hold real estate or stocks that continue to grow in value, with distributions made in a way that minimizes tax liability for beneficiaries.

Some trusts also allow for annual gifting within tax-free limits. The IRS permits individuals to give a certain amount each year—indexed for inflation—to any number of people without triggering gift tax. This amount can be directed into a trust for the benefit of children or grandchildren, allowing wealth to be transferred gradually while reducing the size of the taxable estate. When combined with proper documentation and reporting, this strategy can be a powerful tool for long-term wealth transfer. However, it requires careful coordination with a tax advisor to ensure compliance and avoid unintended consequences. The goal is not to eliminate taxes entirely—such promises are unrealistic and potentially risky—but to use legal, time-tested methods to keep more of what you’ve built within the family.

Choosing the Right Trustee: More Than Just a Name

Selecting a trustee is one of the most consequential decisions in setting up a family trust. This person or institution will have the authority to manage assets, make distributions, and interpret the grantor’s intentions—often years or even decades after the trust is created. Yet, many families make this choice based on emotion rather than practicality, naming a spouse, adult child, or sibling without fully considering the skills required. While family loyalty is important, managing a trust demands financial literacy, organizational ability, and impartiality. A well-meaning but unqualified trustee can make costly mistakes—such as mismanaging investments, failing to file tax returns, or making biased distribution decisions—that undermine the entire purpose of the trust.

One common pitfall is appointing a trustee who lacks financial experience. Managing trust assets involves more than writing checks. It requires understanding investment principles, tax implications, legal responsibilities, and record-keeping. For example, the trustee must ensure that assets are properly diversified, that distributions comply with the trust terms, and that all actions are documented. If the trustee is not comfortable with these responsibilities, the trust may underperform or face legal challenges. In some cases, family dynamics can further complicate matters. A sibling serving as trustee may be accused of favoritism, even if decisions are made fairly. These tensions can lead to disputes, lawsuits, and the breakdown of family relationships—exactly what the trust was meant to prevent.

To address these risks, many families opt for a professional trustee—such as a bank trust department or a licensed fiduciary. These institutions offer expertise, objectivity, and continuity. They are bound by legal and ethical standards to act in the best interests of the beneficiaries and can provide consistent management regardless of personal circumstances. While some worry that professional trustees lack personal connection, they can be paired with a family member as a co-trustee to balance institutional knowledge with emotional insight. This hybrid approach allows for shared decision-making, ensuring that financial prudence is combined with an understanding of family values.

The selection process should involve careful evaluation of candidates, clear definition of duties, and mechanisms for accountability. Grantors should consider whether the potential trustee has the time, willingness, and ability to serve. It’s also wise to name a successor trustee in case the original choice is unable or unwilling to continue. Open conversations with all parties can help set expectations and reduce the risk of future conflict. Ultimately, the right trustee is not necessarily the closest relative, but the one best equipped to honor the grantor’s vision and protect the family’s future.

Setting Rules That Actually Work

A trust is only as effective as the rules that govern it. Poorly drafted provisions—whether too rigid or too vague—can lead to frustration, misinterpretation, or unintended consequences. The goal is to create a framework that balances protection with flexibility, encouraging responsible behavior without stifling independence. One of the most effective approaches is to tie distributions to meaningful milestones. For example, a trust might release funds when a beneficiary graduates from college, reaches a certain age, or achieves financial stability. These conditions provide structure while recognizing personal growth, helping beneficiaries transition from dependence to self-sufficiency.

Another powerful tool is the use of incentive clauses. These provisions reward positive behaviors such as completing education, starting a business, or volunteering in the community. For instance, a trust might offer a matching contribution for every dollar a beneficiary saves toward a home, or provide additional funds for pursuing advanced training. These incentives align financial support with personal development, reinforcing the values the grantor wishes to pass on. At the same time, they help prevent a sense of entitlement, fostering a work ethic and appreciation for the resources available.

It’s equally important to avoid overly restrictive terms that may backfire. A trust that prohibits spending on anything except basic needs, for example, may lead to resentment or rebellion. Similarly, vague language such as “for health, education, and support” gives the trustee broad discretion but may lack clarity in practice. To prevent ambiguity, trust documents should define key terms and outline specific guidelines for distributions. For example, specifying that funds can be used for tuition, books, and room and board makes the intent clear. Including emergency provisions allows the trustee to respond to unforeseen circumstances—such as a medical crisis or job loss—without violating the trust’s purpose.

The most successful trusts are those that reflect a deep understanding of the family’s unique dynamics. A single parent may prioritize stability for a child with special needs, while a business owner may want to support the next generation’s entrepreneurial spirit. By designing rules that are both principled and practical, families can ensure that their trust serves as a tool for empowerment, not control. The result is a legacy that does more than transfer wealth—it nurtures responsibility, resilience, and purpose across generations.

Making It Real: The Practical Steps to Start

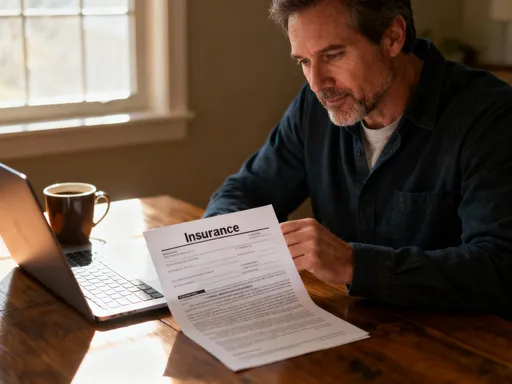

Starting a family trust may seem overwhelming, but the process can be broken down into manageable steps. The first is defining clear goals. What does the family hope to achieve? Is it avoiding probate, protecting a vulnerable beneficiary, reducing taxes, or preserving family harmony? Understanding these objectives helps determine the type of trust and the provisions it should include. Next, the grantor should gather key documents—such as property deeds, bank statements, investment accounts, and insurance policies—to identify which assets will be placed in the trust. This inventory is essential for funding the trust, which is the step many people overlook.

Funding the trust means officially transferring ownership of assets from the individual to the trust. For real estate, this involves changing the deed. For bank and investment accounts, it requires updating the account title. If this step is skipped, the trust may be legally valid but functionally empty—forcing those assets to go through probate anyway. It’s a common mistake, but one that can be easily avoided with careful attention and the help of an attorney. Working with an experienced estate planning lawyer is crucial to ensure the trust is drafted correctly and complies with state and federal laws. While online templates are available, they often lack the customization needed for complex family situations and may not hold up in court.

Once the trust is established and funded, it should be reviewed periodically—especially after major life events such as marriage, divorce, the birth of a child, or significant changes in financial status. Laws and personal circumstances evolve, and the trust should reflect those changes. Open communication with family members can also help ensure everyone understands the purpose and function of the trust, reducing the risk of confusion or conflict later. While it may feel uncomfortable to discuss money and inheritance, these conversations foster transparency and trust.

The truth is, wealth management isn’t about control—it’s about care. A family trust is not a sign of distrust, but a demonstration of love and foresight. It reflects a desire to protect, guide, and support future generations in a meaningful way. For families who have worked hard to build something lasting, a trust offers a quiet but powerful way to ensure that their legacy endures. It’s not reserved for the ultra-wealthy. It’s for anyone who believes that how wealth is passed on matters as much as how it was earned. By taking thoughtful, deliberate steps today, families can create a foundation for stability, unity, and purpose that lasts far beyond a lifetime.