How I Turned My Gym Habits Into Smarter Money Moves

What if your monthly fitness expenses could do more than just tone muscles—what if they helped build wealth? I used to see my gym membership, workout gear, and class fees as pure costs. Then I realized: these recurring spending habits could actually fuel a smarter financial strategy. By treating fitness expenses as a lens for asset diversification, I found practical ways to save, invest, and reduce financial risk—without giving up my healthy lifestyle. This journey wasn’t about cutting back on health; it was about rethinking how everyday choices can support long-term financial well-being. The shift began with awareness and ended with a system that lets me stay fit while quietly growing my savings and investments.

The Hidden Cost of Staying Fit

Fitness is often celebrated for its physical and mental benefits, but few consider its financial footprint. For many individuals, particularly those committed to an active lifestyle, monthly spending on gym memberships, personal training, wellness subscriptions, and athletic apparel accumulates into a substantial sum. A premium gym membership alone can range from $80 to $150 per month, amounting to nearly $1,800 annually. Add to that the cost of specialized classes like spin, Pilates, or yoga—often priced between $20 and $40 per session—and the total climbs quickly. Over five years, these expenses can surpass $10,000, a figure comparable to a mid-tier vacation or a significant portion of a down payment on a reliable used car.

Beyond the obvious charges, there are secondary costs that often go unnoticed. High-performance sportswear from well-known brands can cost hundreds of dollars a season. Supplements, protein powders, and recovery drinks add another $50 to $100 monthly for dedicated users. Even travel to and from fitness studios, especially in cities where parking or ride-share fees apply, contributes to the overall expense. These are not one-time purchases but recurring outflows that, while individually modest, compound over time. Because they are habitual and often automated through recurring payments, they rarely trigger the same scrutiny as larger financial decisions like car loans or home repairs.

What makes this spending particularly insidious is its emotional justification. Unlike discretionary luxuries such as dining out or entertainment, fitness expenses are often viewed as investments in health. This positive association makes them less likely to be questioned, even when underutilized. Studies show that the average gym member uses their membership less than three times per week, and a significant number attend fewer than once a week. Yet, they continue to pay full price, essentially funding a service they barely use. This disconnect between cost and value represents a missed opportunity to redirect funds toward more productive financial goals.

Recognizing the true cost of fitness is not about discouraging healthy habits. Instead, it is about bringing intentionality to spending that is too often on autopilot. When individuals begin to see their fitness budget as a structured expense category, similar to utilities or transportation, they gain the clarity needed to make strategic adjustments. The goal is not elimination but optimization—finding ways to maintain wellness while ensuring that money flows with purpose. This awareness marks the first step toward transforming passive spending into active wealth-building.

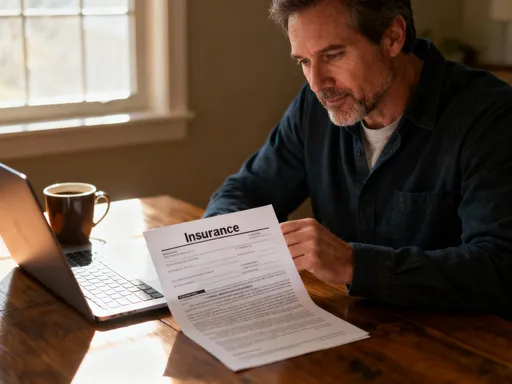

Why Fitness Spending Deserves a Financial Strategy

Fitness spending is not an anomaly; it is a predictable, recurring expense, much like rent, groceries, or car payments. Because of its regularity, it offers a unique advantage in financial planning: consistency. Most people pay their gym fees or wellness subscriptions on the same day each month, creating a reliable pattern that can be leveraged for smarter money management. Rather than treating these payments as unavoidable losses, they can be reframed as indicators of financial behavior—clues that reveal spending habits, priorities, and potential areas for redirection. This shift in perspective turns an everyday expense into a strategic tool for long-term financial health.

One of the core principles of sound personal finance is the alignment of spending with values and goals. When individuals mindlessly pay for fitness services they rarely use, they are not aligning their money with their actual behavior. However, when they audit these expenses and make deliberate choices, they begin to practice financial discipline. This discipline is transferable. The same mindset that allows someone to evaluate whether a $120 monthly gym membership is worth the cost can be applied to assessing investment opportunities, insurance plans, or retirement contributions. In this way, fitness spending becomes a training ground for broader financial decision-making.

Moreover, because fitness expenses are often discretionary within a certain range, they offer flexibility. Unlike fixed costs such as mortgage payments or minimum debt obligations, gym memberships can be modified, downgraded, or replaced with lower-cost alternatives. This flexibility makes the fitness category an ideal starting point for reallocating funds. For example, switching from a premium gym to a community center might save $80 per month. That $80, when redirected, could be used to increase contributions to a retirement account, build an emergency fund, or invest in a diversified index fund. Over time, even modest monthly savings can generate meaningful returns through compound growth.

The psychological benefit of linking fitness and finance should not be underestimated. Many people find it difficult to engage with financial planning because it feels abstract or intimidating. By anchoring financial decisions to a familiar and positive habit like exercise, individuals can make money management feel more accessible and rewarding. Each time they choose a cost-effective workout option, they can view it as a dual victory: maintaining their health while also advancing their financial goals. This synergy reinforces positive behavior and creates a feedback loop that supports long-term success in both domains.

From Expense Tracking to Financial Awareness

The foundation of any effective financial strategy is awareness, and the first step toward awareness is accurate tracking. Without a clear picture of where money is going, it is impossible to make informed decisions. This is especially true for fitness-related spending, which often includes multiple small, recurring charges that blend into the background of monthly expenses. To gain control, individuals must begin by categorizing every fitness-related transaction, no matter how minor. This includes not only gym memberships and class fees but also purchases of workout clothes, fitness apps, water bottles, travel to studios, and even post-workout smoothies bought on the way home.

Modern banking tools and budgeting applications make this process more manageable than ever. Many digital banks now offer automatic categorization features that label transactions based on merchant names. For instance, a charge from “Fitness Plus LLC” might be tagged as “Gym Membership,” while a purchase from a sportswear retailer is labeled “Apparel.” Budgeting apps like Mint, YNAB (You Need A Budget), or PocketGuard allow users to create custom categories and set spending limits. By reviewing these categories monthly, individuals can see exactly how much they are spending on fitness and identify patterns, such as rising supplement costs or unused subscription renewals.

Real-life scenarios illustrate the power of this approach. Consider a woman who pays $100 per month for a gym membership, $30 for a weekly yoga class, $40 for protein powder, and occasionally spends $75 on new leggings. On the surface, these expenses seem reasonable. But when tracked over 12 months, the total reaches $2,580—enough to cover a family weekend getaway or make a meaningful contribution to a child’s education fund. More importantly, she discovers that she only used the gym 45 times in a year, averaging less than once a week. This revelation prompts her to explore alternatives, such as outdoor workouts or community center programs, freeing up hundreds of dollars annually.

The act of tracking also exposes “financial leaks”—small, recurring charges that accumulate without adding proportional value. These might include a $9.99 monthly meditation app subscription that is rarely opened, a $15 fee for a locker at the gym that is seldom used, or impulse purchases of energy bars at the studio front desk. Individually, these costs seem negligible, but collectively, they can amount to hundreds of dollars a year. By identifying and eliminating these leaks, individuals gain not only financial relief but also a sense of empowerment. They shift from being passive spenders to active managers of their money, a mindset that is essential for long-term financial success.

Building a Diversified Financial Base

Asset diversification is a cornerstone of prudent investing, yet many people associate it only with stock portfolios or retirement accounts. In reality, the principle of diversification begins much earlier—with everyday spending decisions. Just as a balanced workout routine includes strength training, cardio, and flexibility exercises to build overall fitness, a healthy financial life requires spreading resources across different types of assets to reduce risk. Over-relying on a single investment or spending category creates vulnerability, whether in the gym or in the market. By applying diversification principles to fitness spending, individuals can create a more resilient financial foundation.

The analogy between physical and financial health is powerful. A person who only does high-intensity interval training may build endurance but risk injury due to lack of flexibility or recovery. Similarly, someone who invests all their savings in a single stock or sector may see short-term gains but faces significant risk if that investment declines. The solution in both cases is balance. In finance, this means allocating funds across different asset classes such as stocks, bonds, real estate, and cash equivalents. Even small, consistent contributions to diversified accounts can protect against market volatility and generate steady long-term growth.

The connection to fitness spending lies in redirection. Instead of allowing all discretionary funds to flow into a single category like gym fees, individuals can redirect a portion toward diversified financial vehicles. For example, someone who saves $75 per month by switching to a lower-cost fitness option could allocate that amount to a broad-market index fund, which historically has returned about 7% annually over the long term. After 10 years, that $75 monthly contribution would grow to over $13,000, assuming average market performance. The same principle applies to retirement accounts like a 401(k) or IRA, where employer matches and tax advantages enhance the benefits of consistent contributions.

Diversification is not just about investment vehicles; it also involves creating multiple financial safety nets. An emergency fund, for instance, acts as a buffer against unexpected expenses, reducing the need to rely on high-interest debt. Health savings accounts (HSAs) offer another layer of protection, especially for those with high-deductible insurance plans, by allowing tax-free contributions for medical expenses. By viewing fitness spending as part of a larger financial ecosystem, individuals can make choices that support both immediate well-being and long-term stability. The goal is not to eliminate fitness costs but to ensure they exist within a balanced, diversified financial plan.

Smart Substitutions That Save and Invest

One of the most effective ways to improve financial health without sacrificing lifestyle is through smart substitutions—practical, low-effort changes that maintain quality of life while freeing up resources. In the context of fitness, these substitutions are not about deprivation but optimization. They involve identifying higher-cost habits and replacing them with equally effective, lower-cost alternatives. The savings generated are then systematically redirected into investment or savings accounts, creating a seamless link between daily choices and long-term wealth accumulation.

Consider the choice of gym. Premium fitness centers often offer luxurious amenities such as saunas, towel service, and boutique classes, but these features come at a premium price. For many, a community center, public recreation facility, or even a local YMCA provides access to quality equipment, group classes, and personal training at a fraction of the cost. A membership at such facilities might cost $30 to $50 per month, saving $50 to $100 compared to a high-end gym. These savings can be automatically transferred to a retirement account or a diversified brokerage account, where they begin earning returns immediately.

Another powerful substitution is the shift from paid classes to free or low-cost alternatives. Outdoor fitness groups, park-based boot camps, and online workout platforms like YouTube offer structured routines at no cost. Many cities host free community fitness events, especially in warmer months, providing social motivation without the price tag. Even fitness apps, while convenient, can be replaced with free versions or library-accessed programs. The key is consistency, not cost. A daily 30-minute walk or bodyweight routine at home can be just as effective as a $30 spin class, especially when done regularly.

Employer wellness programs represent another underutilized opportunity. Many companies offer incentives such as gym membership reimbursements, fitness challenges with cash rewards, or on-site classes at no cost. Some even provide health savings account (HSA) contributions for completing wellness activities. By taking full advantage of these benefits, employees can reduce out-of-pocket fitness costs while improving their financial position. The saved money, when invested rather than spent, compounds over time, turning wellness initiatives into wealth-building tools. Over a decade, consistent substitutions and reinvestment can result in thousands of dollars in additional savings and investment growth.

Automating the Link Between Spending and Investing

Behavioral finance research consistently shows that people are more likely to follow through on financial goals when systems are automated. Willpower is limited, but technology can bridge the gap between intention and action. This is especially relevant when linking fitness spending to investing. By setting up automated tools, individuals can ensure that every dollar saved through smarter fitness choices is immediately put to work in growing their wealth. The process requires minimal effort but yields significant long-term benefits.

One popular method is using round-up apps, such as Acorns or Chime, which link to a user’s debit or credit card and automatically invest the spare change from everyday purchases. For example, if someone buys a $9.99 workout drink, the app rounds up to $10 and invests the $0.01 difference. While this amount seems trivial, it accumulates over time, especially with frequent transactions. When applied to fitness-related spending, the round-up feature can generate a steady stream of micro-investments without requiring additional budgeting. Over a year, these small amounts can total hundreds of dollars invested in diversified ETFs or index funds.

Another effective strategy is setting up parallel accounts: one dedicated to fitness expenses and another to investment goals. Each month, after paying essential fitness costs, the individual transfers a predetermined amount from their checking account to a brokerage or retirement account. This transfer can be scheduled to occur on the same day as the gym payment, creating a psychological link between spending and saving. Over time, this habit reinforces the idea that every dollar spent has the potential to generate future value. The invested funds grow through compound interest, and the account balance becomes a visible representation of progress.

Automation also reduces emotional decision-making. When investment contributions are manual, they are vulnerable to being skipped during tight months or redirected to other needs. But when they are automatic, they become a non-negotiable part of the financial routine, just like a gym membership fee. This consistency is crucial for long-term success. Even small, regular investments can outperform larger, irregular ones due to the power of compounding. By removing the need for constant vigilance, automation makes financial growth accessible and sustainable for everyone, regardless of income level or financial expertise.

Long-Term Gains: Health and Wealth Growing Together

The ultimate goal of aligning fitness habits with financial strategy is not just to save money but to build a life of sustained well-being. When health and wealth are pursued in tandem, they reinforce each other, creating a cycle of positive outcomes. Regular physical activity improves energy, focus, and resilience—qualities that enhance productivity and career success. At the same time, financial stability reduces stress, improves sleep, and supports better health choices. By recognizing the interplay between these two domains, individuals can design a lifestyle where every decision contributes to a stronger, more secure future.

The compounding effect of small, consistent actions cannot be overstated. Saving $50 a month by choosing a community gym and investing that amount in a diversified portfolio may seem insignificant in the short term. But over 20 years, at a 7% annual return, that $50 grows to nearly $25,000. The same principle applies to eliminating unused subscriptions or using free workout resources. Each small change, when repeated and reinvested, accumulates into meaningful financial progress. More importantly, these habits cultivate a mindset of intentionality, where every dollar is seen not as a cost but as a potential seed for growth.

True financial health is not about austerity; it is about alignment. It is possible to enjoy a rich, active life while also building wealth, as long as spending reflects values and goals. Fitness should not be sacrificed for finance, nor should financial security be ignored for the sake of convenience. Instead, the two can coexist and even thrive together when managed with awareness and strategy. By treating fitness expenses as a starting point for broader financial planning, individuals gain control, clarity, and confidence.

In the end, diversification is more than an investment strategy—it is a philosophy. It means spreading risk, embracing balance, and planning for the long term. Whether in exercise, diet, or money management, variety and consistency lead to resilience. The journey from automatic spending to intentional investing begins with a single question: “Where is my money going, and is it working for me?” For those willing to look closely, the answer can transform not just their finances, but their entire approach to life. Health and wealth, when nurtured together, create a foundation for lasting fulfillment and peace of mind.