How I Launched My Side Hustle Without Betting the Farm

You’re not alone if you’ve ever dreamed of starting a side business but froze at the thought of risking your savings. I’ve been there—scared to dip my toes in, worried about failure. But what if you could grow a business *and* protect your finances at the same time? That’s exactly what I did by treating my side hustle like part of a bigger financial puzzle. Turns out, launching smart isn’t about luck—it’s about strategy, balance, and playing defense as much as offense. It’s about building something meaningful without sacrificing the stability you’ve worked so hard to create. For many women juggling family, work, and personal goals, the idea of adding another responsibility can feel overwhelming. But when approached with care, a side hustle can become not just a source of extra income, but a tool for long-term financial confidence and independence.

The Side Hustle Trap: Why Most People Risk Too Much

Every year, millions of people launch side businesses hoping to turn passion into profit. Yet, a significant number stumble early—not because their ideas lack merit, but because they take on too much financial risk too soon. The allure of quick success often leads entrepreneurs to drain emergency funds, max out credit cards, or pour savings into equipment, marketing, and inventory before validating demand. This pattern is especially common among well-intentioned individuals who believe that going all-in demonstrates commitment. But in reality, over-investing at the start can backfire, turning a promising venture into a source of stress and financial strain.

Consider the story of a woman who left her teaching job to launch an online boutique selling handmade children’s clothing. She invested nearly $15,000 in inventory, website development, and photography, convinced that her unique designs would sell quickly. Within six months, she realized that customer demand was far lower than expected, and she had little cash left to pivot or adapt. This is not an isolated case. According to data from the U.S. Bureau of Labor Statistics, about 20% of small businesses fail within the first year, and cash flow problems are a leading cause. The emotional attachment to an idea can cloud judgment, making it difficult to assess whether spending is strategic or simply hopeful.

The distinction between boldness and recklessness often comes down to preparation. Launching a side hustle doesn’t require abandoning financial prudence. Instead, it calls for a mindset shift—viewing your business as one component of a broader financial life, not the sole focus. This means asking hard questions before spending: Is this expense necessary right now? Can I test this idea with less investment? What happens if revenue doesn’t materialize as quickly as I hope? Answering these honestly helps prevent emotional decision-making and keeps your financial foundation intact.

Moreover, many overlook the hidden costs of entrepreneurship—time, energy, and opportunity cost. Every hour spent managing a side business is an hour not spent on family, rest, or primary employment. When financial pressure mounts, these trade-offs become even heavier. By recognizing the common pitfalls—over-investment, lack of validation, and emotional bias—entrepreneurs can avoid the trap of risking too much too soon. The goal isn’t to play it safe at all costs, but to take calculated, informed steps that protect both your dreams and your financial well-being.

Asset Diversification Isn’t Just for Investors—It’s for Founders Too

When most people hear the term “asset diversification,” they think of stock portfolios or retirement accounts. But this principle is just as vital for anyone starting a side business. Diversification isn’t just a tool for minimizing investment risk—it’s a foundational strategy for long-term financial resilience, especially when launching a new venture. At its core, diversification means not relying on a single source of income or asset to carry your entire financial life. For a side hustle founder, this means ensuring that your business is one part of a balanced financial picture, not the only piece.

Imagine building a house on a single pillar. If that pillar cracks, the whole structure is at risk. The same logic applies to finances. If your side hustle becomes your sole focus—emotionally and financially—any setback in the business can quickly spill over into your personal life. A slow sales month, a supply chain delay, or a shift in customer preferences can feel catastrophic if your savings are tied up in the venture. But when you maintain a diversified financial base—keeping emergency funds intact, continuing contributions to retirement accounts, and preserving other income streams—you create a buffer that allows your business room to grow without threatening your security.

Take the example of a woman who launched a home-based baking business while keeping her full-time job. Instead of withdrawing from her 401(k) to buy equipment, she used a small portion of her savings—capped at 5% of her liquid assets—and started with secondhand tools. She continued contributing to her retirement account and kept her emergency fund untouched. Over time, her business grew, but because she didn’t overcommit financially, she could absorb slower months without panic. This approach allowed her to scale gradually, reinvest profits wisely, and maintain peace of mind.

Diversification also applies to income types. Relying solely on active income—time-for-money trades—is inherently risky. Adding passive or semi-passive streams, such as dividend-paying investments, rental income, or digital products, creates stability. When a side hustle is treated as one of several financial engines, it reduces pressure to succeed immediately. This mindset shift—from “this business must work” to “this business is one path among many”—frees entrepreneurs to make smarter, less desperate decisions. In the long run, financial resilience comes not from betting everything on one idea, but from building multiple layers of security that support sustainable growth.

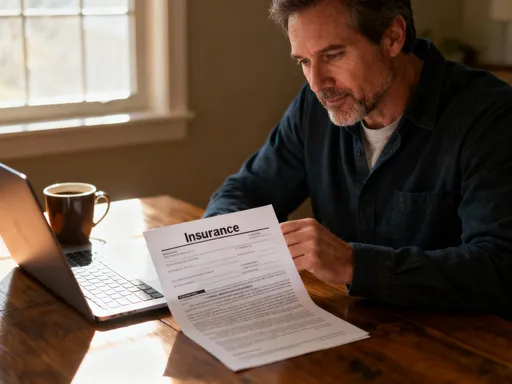

Building Your Financial Safety Net Before Launch Day

One of the most overlooked steps in launching a side hustle is preparing the financial foundation *before* the first dollar is spent. Too often, aspiring entrepreneurs focus on branding, website design, or product development without first securing their personal finances. But just as a builder wouldn’t pour a foundation on unstable ground, you shouldn’t launch a business without a solid financial base. The most important element of this foundation is an emergency fund—typically three to six months’ worth of living expenses set aside in a liquid, accessible account. This fund acts as a safety net, allowing you to navigate unexpected setbacks without resorting to debt or dipping into retirement savings.

Equally important is managing existing debt. High-interest debt, such as credit card balances, can erode financial flexibility and increase stress. Before launching a side hustle, it’s wise to create a plan to reduce or stabilize debt levels. This doesn’t mean you must be completely debt-free, but rather that you have a clear understanding of your obligations and the capacity to manage them alongside new business expenses. For many women balancing household budgets, this step involves honest conversations about spending priorities and finding ways to free up cash flow—such as cutting non-essential subscriptions or refinancing loans at lower rates.

Another key part of the pre-launch checklist is income buffering. If your primary job is your main source of income, it’s crucial to protect it. This means avoiding situations where your side hustle could conflict with your employer’s policies or consume so much energy that your performance suffers. A sustainable approach is to start small—dedicating a few hours a week to your business—and scaling only when you see consistent demand. This phased entry reduces financial pressure and allows you to test ideas without major risk.

Validation is also a critical component of financial preparedness. Instead of spending thousands on inventory or a professional website, consider low-cost ways to test your concept. For example, a woman who wanted to start a meal prep service began by offering weekly menus to friends and neighbors, collecting payments in advance. This pre-order model not only generated initial revenue but also confirmed that there was real demand. Similarly, service-based businesses can offer trial sessions or limited-time packages to gauge interest. These methods provide valuable feedback while minimizing upfront costs. By taking these steps *before* launch, you create a financial runway that gives you time to learn, adapt, and grow—without the constant fear of failure.

Smart Funding: Using Personal Assets Without Draining Them

Funding a side hustle doesn’t have to mean taking on debt or seeking outside investors. Many successful entrepreneurs get started by leveraging existing personal assets—cash, tools, space, or skills—without putting their financial stability at risk. The key is to approach funding with the discipline of an investor, not the urgency of a dreamer. This means setting clear limits on how much you’re willing to contribute and defining what success looks like before committing any resources. A practical strategy is to establish a personal “investment cap”—for example, no more than 10% of your liquid savings—and treat that amount as a one-time contribution, not an open-ended commitment.

Consider the case of a woman who launched a home-based sewing business using a machine she already owned. Instead of buying new equipment, she repaired her old one and used fabric scraps from past projects to create sample products. She allocated $500 from her savings to cover initial marketing and registration fees, knowing that if the business didn’t gain traction within six months, she could walk away without long-term consequences. This approach allowed her to start small, learn quickly, and reinvest profits as demand grew. By treating her contribution like a business investment—with expectations of return and a timeline for evaluation—she maintained control and avoided emotional overspending.

Home equity is another asset some entrepreneurs consider, but it requires careful thought. While a home equity line of credit (HELOC) can provide low-interest funding, it also puts your home at risk if the business fails. For most side hustlers, especially those just starting, it’s wiser to avoid secured debt and instead focus on unsecured, low-cost options. Using spare cash, reallocating household budgets, or selling unused items can generate startup funds without adding financial pressure. The goal is to fund growth in stages, not all at once. Each phase should be evaluated based on results, allowing you to decide whether to continue, adjust, or pause.

Another smart funding practice is to separate business and personal finances from day one. Opening a dedicated business bank account—even if it’s just a free online account—creates clarity and makes it easier to track expenses, file taxes, and measure profitability. It also reinforces the mindset that your side hustle is a real business, not just a hobby. When you see money moving in and out of a professional account, you’re more likely to make thoughtful decisions. Smart funding isn’t about how much you spend, but how wisely you allocate resources. By using personal assets strategically and setting clear boundaries, you can build momentum without compromising your financial security.

Balancing Time, Money, and Risk Across Multiple Roles

For many women, the challenge of running a side hustle isn’t just financial—it’s logistical. Juggling a full-time job, family responsibilities, and personal time leaves little room for entrepreneurship. Yet, with careful planning, it’s possible to integrate a side business into a busy life without burning out. The key is recognizing that time and energy are finite resources, just like money. This means being intentional about how you allocate them and understanding your personal “financial bandwidth”—the amount of risk you can realistically manage without compromising your well-being.

Time-blocking is one of the most effective strategies for maintaining balance. By scheduling specific hours each week for business tasks—such as marketing, product creation, or customer service—you create structure and prevent work from spilling into personal time. For example, dedicating Saturday mornings to batch-cooking meals for a catering side hustle, or using weekday evenings to respond to client inquiries, helps maintain boundaries. The goal isn’t to work more, but to work smarter. Protecting downtime is just as important as protecting income; rest and family time recharge the emotional reserves needed to sustain long-term effort.

Outsourcing small tasks can also free up valuable time. While it may seem counterintuitive to spend money when trying to save, paying for help with repetitive or time-consuming tasks—like bookkeeping, packaging, or social media scheduling—can increase efficiency and reduce stress. Many women find that spending $50 a month on a virtual assistant allows them to focus on higher-value activities, such as customer relationships or product development. The return on investment isn’t always measured in immediate profit, but in preserved energy and mental clarity.

Tracking progress without obsession is another crucial balance. It’s important to monitor income, expenses, and customer feedback, but constantly checking numbers can lead to anxiety. Instead, set regular check-in points—such as weekly reviews or monthly financial summaries—to assess performance without micromanaging. This approach fosters patience and perspective, reminding you that growth takes time. By treating your side hustle as a long-term project rather than a quick fix, you reduce pressure and increase the likelihood of sustainable success. Balancing time, money, and risk isn’t about perfection—it’s about making consistent, thoughtful choices that align with your life and goals.

Measuring Success Beyond Monthly Profits

When most people think of business success, they focus on monthly profit—the bottom line that shows how much money was made. But for a side hustle, especially in the early stages, profit alone is a narrow and sometimes misleading metric. A more complete picture of success includes financial health indicators such as cash runway, personal draw limits, and opportunity cost. Cash runway refers to how long you can operate based on current savings and income—if your business isn’t profitable yet, how many months can you sustain it without dipping into emergency funds? This number provides a realistic sense of stability and helps you plan for the future.

Personal draw limits are another important measure. This is the amount of money you allow yourself to take from the business for personal use. Setting a limit—such as no more than $200 per month—prevents you from treating the business as a personal ATM and ensures that enough capital stays in the business to support growth. It also creates discipline, forcing you to prioritize essential expenses and delay non-critical purchases. Many side hustlers unknowingly drain their ventures by taking out money to cover household bills, which can stall development and extend the path to sustainability.

Opportunity cost is a less visible but equally important factor. This refers to what you’re giving up by investing time and money in your side hustle. For example, if you spend 15 hours a week on your business, what else could you do with that time? Could those hours be used for rest, family, or professional development? Evaluating opportunity cost helps you determine whether the venture is truly adding value to your life or quietly consuming resources without sufficient return. It’s not about stopping the business, but about making informed choices.

Regular financial checkups—quarterly or semi-annually—can help you stay aligned with your goals. During these reviews, ask questions like: Is this business moving me closer to financial independence? Am I learning new skills that increase my long-term value? Does the stress level outweigh the benefits? These reflections go beyond numbers and touch on personal fulfillment and well-being. Measuring success this way ensures that your side hustle serves you, not the other way around. It transforms the journey from a race for profit into a thoughtful, values-driven process that builds both wealth and confidence.

From Side Gig to Sustainable Growth—Without Losing Balance

There comes a moment in every side hustle journey when growth begins to accelerate. Orders increase, referrals pour in, and the business starts to feel like it could become something bigger. This is an exciting phase, but it’s also a critical one. The temptation to scale quickly—hire help, expand product lines, quit the day job—can be overwhelming. Yet, history shows that rapid scaling without a solid foundation often leads to burnout, cash flow shortages, or loss of control. Sustainable growth isn’t about how fast you move, but how steadily you build. It’s about advancing without sacrificing the balance that made your success possible in the first place.

Reinvesting profits wisely is a cornerstone of sustainable growth. Instead of spending every extra dollar on flashy upgrades, prioritize investments that increase efficiency or reduce long-term costs. For example, upgrading from manual invoicing to accounting software may cost a few hundred dollars upfront but save hours each month. Similarly, investing in high-quality materials can reduce waste and improve customer satisfaction. The key is to evaluate each expense based on its potential return and alignment with long-term goals. This disciplined approach ensures that growth is funded by earnings, not debt or emotional decisions.

Knowing when to scale requires honest self-assessment. Are you consistently meeting demand? Do you have systems in place to handle more volume? Is your personal well-being stable? These questions help determine whether expansion is truly feasible. Many successful founders wait until their side hustle income reliably covers a significant portion of their living expenses—say, 40% to 50%—before considering a full-time transition. This buffer provides security and reduces the pressure to succeed immediately. It also allows time to build operational systems, such as inventory management or customer service protocols, that support larger operations.

Perhaps the most important principle is maintaining diversification even as income grows. Just because your side hustle starts earning more doesn’t mean you should abandon other financial safeguards. Continuing to save, invest, and protect emergency funds ensures that you don’t become overly dependent on a single income stream. Stability isn’t the enemy of ambition—it’s the foundation that makes bold moves possible. Lasting wealth isn’t built on big bets, but on smart, steady choices that compound over time. By launching with caution, growing with intention, and protecting your financial balance at every stage, you create not just a business, but a legacy of resilience and confidence.